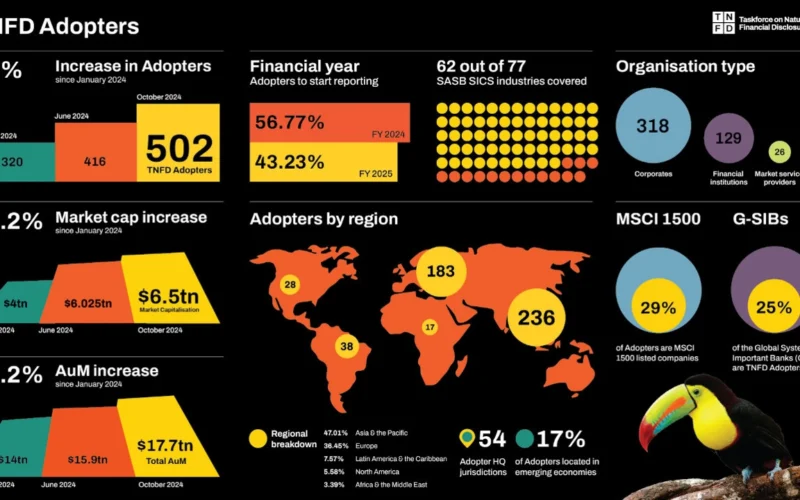

The Taskforce on Nature-related Financial Disclosures (TNFD) announced that 502 companies and financial institutions have committed to voluntary reporting of nature-related risks in line with TNFD recommendations, reflecting a 57% increase since the initiative’s first Adopters announcement in January 2024.

The TNFD’s framework aligns with the Global Biodiversity Framework (GBF), particularly Target 15, which calls for government-mandated corporate reporting on nature-related dependencies, impacts, and risks by 2030. This growth highlights the market’s proactive approach to nature-related risk management, showcasing strong alignment with global biodiversity goals.

These adopters span 54 jurisdictions, including 25 emerging markets, and cover 62 of 77 SASB SICS sectors, representing a combined market capitalization of over $6.5 trillion—an 8% rise since London Climate Action Week in June 2024. Currently, 129 financial institutions have registered as TNFD Adopters, accounting for $17.7 trillion in assets under management, an 11% increase from June. Notably, these include 25% of the world’s systemically important banks.

David Craig, Co-Chair of the TNFD commented, “The speed of voluntary market adoption over the past year since the release of the TNFD recommendations highlights the growing appreciation among companies and financial institutions across sectors and geographies that nature is a material risk issue for their business and a new source of opportunity and potential competitive advantage. We have seen significant uptake across sectors – in particular from asset managers, as they address climate and nature risk in their portfolios. Going forward, the growth in these assessments and public disclosures is helping direct financial flows towards more resilient business models and nature-positive outcomes.”

Among recent adopters are financial firms like abrdn, Banco de Bogotá, and Manulife Investment Management; professional services giant KPMG; metals and mining company Freeport-McMoRan; airline Qantas; food retailers Morrisons and Sainsbury’s; steel producers Jindal Stainless Limited and JSW Group; solar developer JA Solar Technology; electronics companies Mitsubishi Electric Corp and Philips; electric utilities such as EDP, Electrobras, and Tokyo Electric Power; and tech hardware maker Logitech International.

These organisations plan to integrate TNFD-aligned disclosures into their annual reporting for FY2024 or FY2025, demonstrating a commitment to transparency on nature-related financial risks.

Prabodha Acharya, Chief Sustainability Officer at JSW Group, said, “TNFD is guiding our efforts to align our broader environmental, social and governance efforts as we integrate nature-related risks into JSW Group’s overall sustainability strategies.”

Brian Kernohan, Chief Sustainability Officer at Manulife Investment Management said, “With over 40 years of experience as an institutional manager of natural capital investments and as one of the pioneers in issuing a TNFD-aligned nature disclosure, becoming a TNFD Adopter is a logical next step for us.”

Juan Jose Freijo, Chief Sustainability Officer at Brambles commented, “The TNFD challenges a deeper investigation of a business’s dependencies and impacts on the natural world and its ecosystems so that companies can develop an integrated strategy that accounts for how their resource base can support long-term value creation. It also facilitates a more holistic approach to macro-level risk management while focusing the strategy on the commercial opportunities available in a more sustainable social and economic system.”

Sarah Moody, Chief Corporate Affairs & Sustainability Officer at abrdn said, “Becoming a TNFD Adopter is a vital step on our sustainability journey. Alongside this, we are developing an engagement approach within our investments team focused on the companies with the most material exposure to nature and are seeking the best approaches to data gathering on nature-related impacts.”

John McCalla Leacy, Head of Global ESG at KPMG International remarked, “I am proud that KPMG International is a TNFD Adopter and I am equally proud of the nature and biodiversity practitioners across our global organisation, that are working with their clients to facilitate the changes that are so urgently needed to deliver a nature positive future.”