A new report by global consultancy firm Kearney has found that 69% of chief financial officers (CFOs) expect sustainability initiatives to yield higher returns than traditional investments, highlighting a growing shift towards environmentally responsible financial strategies.

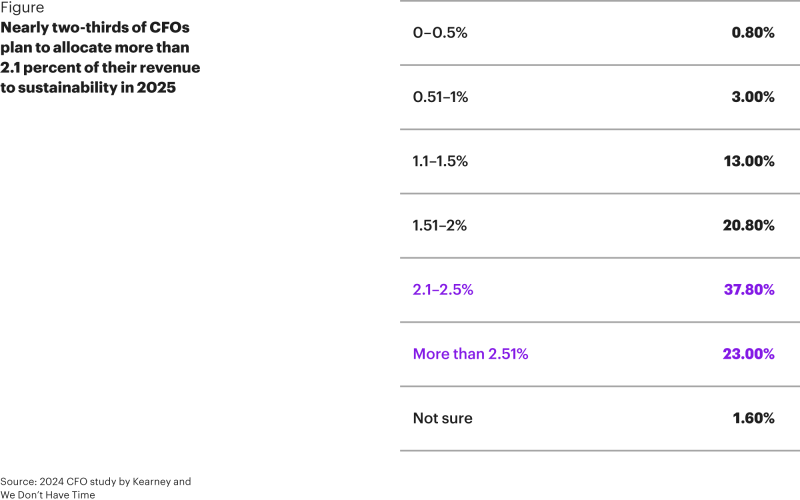

The study, ‘Staying the Course: Chief Financial Officers and the Green Transition’, surveyed 500 CFOs across the United Kingdom, United States, United Arab Emirates, and India. The findings indicate strong confidence in the long-term value of sustainable investments, with 92% of respondents anticipating a significant increase in net investment in green initiatives this year, despite economic uncertainty and financial pressures.

While 93% of CFOs recognise the business case for sustainability investments, motivations behind these decisions vary. The report reveals that 61% continue to view sustainability through a cost-focused lens rather than considering its broader long-term value.

There is, however, a growing awareness of the risks posed by climate change and regulatory measures. The research found that 65% of CFOs are now assessing the cost of inaction, reflecting increased recognition of both financial risks and opportunities associated with the transition to a low-carbon economy.

CFOs are prioritising sustainability measures that provide clear, short-term benefits in emissions reduction. The report identifies three primary areas of focus increasing the use of sustainable materials, driving innovation through sustainability-focused partnerships, and enhancing energy management and waste reduction.

The study also highlights the growing influence of employees on corporate investment decisions. More than 71% of CFOs are now incorporating sustainability considerations into employee retirement fund selections, indicating a broader shift towards values-driven investment strategies.

As awareness of ESG factors rises, the report suggests that CFOs are increasingly recognising the dual benefits of sustainable investments, both in terms of financial performance and alignment with investor and workforce expectations. A large majority—94%—now factor sustainability into broader financial decision-making.

With sustainability reporting requirements tightening, CFOs are taking on a more significant role in climate-related financial disclosures. As the UK government prepares to introduce its Sustainability Disclosure Standards, businesses will need to reassess how they measure and communicate their environmental impact.

The report suggests that CFOs will be central to navigating these regulatory changes, reinforcing their expanding responsibility in corporate sustainability strategies.