Data provider Clarity AI has identified 70 funds that violate the European Securities and Markets Authority’s (ESMA) new guidelines on sustainable fund-naming, primarily due to investments in use-of-proceeds bonds. The ESMA rules mandate that funds using ESG or sustainability-related terms must implement exclusion screens in line with the EU’s Paris-aligned Benchmark (PAB) regulation. Transition funds, meanwhile, are subject to less stringent exclusion criteria from the Climate Transition Benchmarks.

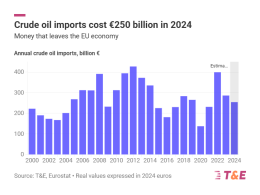

The PAB exclusion rules target companies with norms violations and those involved in coal, oil, and gas production. One of the most significant concerns for green bond investors is the rule excluding companies that derive more than 50% of revenue from electricity generation with an intensity exceeding 100 grams of CO2 equivalent per kWh.

Clarity AI’s research revealed that more than half of the 3,200 funds analysed, which have environmental or impact-related terms in their names, would need to either divest at least one holding or rebrand. Many breaches are due to investments in a small subset of widely held companies. For example, three automotive companies in breach of the UN Global Compact appeared across more than 500 funds.

A new analysis highlights that of the funds impacted by ESMA’s guidelines, 70 are in violation solely due to holdings in use-of-proceeds or sustainability-linked bonds (SLBs). These funds will need to divest from those holdings or alter their names. The analysis also found 282 ESG-labeled bonds from 26 issuers that violate the exclusions, with more than 75% of them linked to fossil fuel or carbon-intensive energy generation.

There has been market pushback against the rules, particularly over their impact on the green bond market. The International Capital Markets Association (ICMA) has called for exceptions for credible green and sustainability-linked bond issuers. Analysts have also noted that utilities, many of which are likely to breach PAB limits, may be early adopters of the EU green bond standard.

ESMA did not comment on its green bond plans but has previously stated there would be no exemptions for use-of-proceeds instruments from excluded companies. A spokesperson noted that funds wanting to invest in such companies while retaining ESG-related terms must use “transition” terms instead.

Investors have until mid-May 2024 to comply with the rules for existing funds, while new funds must adhere to them in two months.

Meanwhile, Barclays analysts warned that MSCI’s revised methodology for aligning with PAB exclusions might overestimate the number of companies affected by ESMA’s fund-naming rules. MSCI adjusted its PAB screening process in July, merging oil and gas revenues under one threshold, potentially inflating the number of excluded companies. This change, along with a revised emissions-intensive generation methodology, increased the number of issuers flagged by around 25%, adding an estimated $7.5 billion of assets to the divestment list.

Barclays researchers cautioned that MSCI’s conservative approach could lead investors to rely on other data sources or conduct in-house analysis, highlighting a potential divergence of opinion among data providers regarding issuer eligibility under ESMA’s guidelines.