Investment in low-emissions hydrogen is gaining momentum, but policies to drive demand in crucial sectors like heavy industry, refining, and long-distance transport are essential to accelerate its deployment, according to a new report from the International Energy Agency (IEA).

The IEA’s Global Hydrogen Review 2024 highlights a surge in new projects, despite challenges from regulatory uncertainties, persistent cost pressures, and a lack of incentives to boost demand among potential consumers.

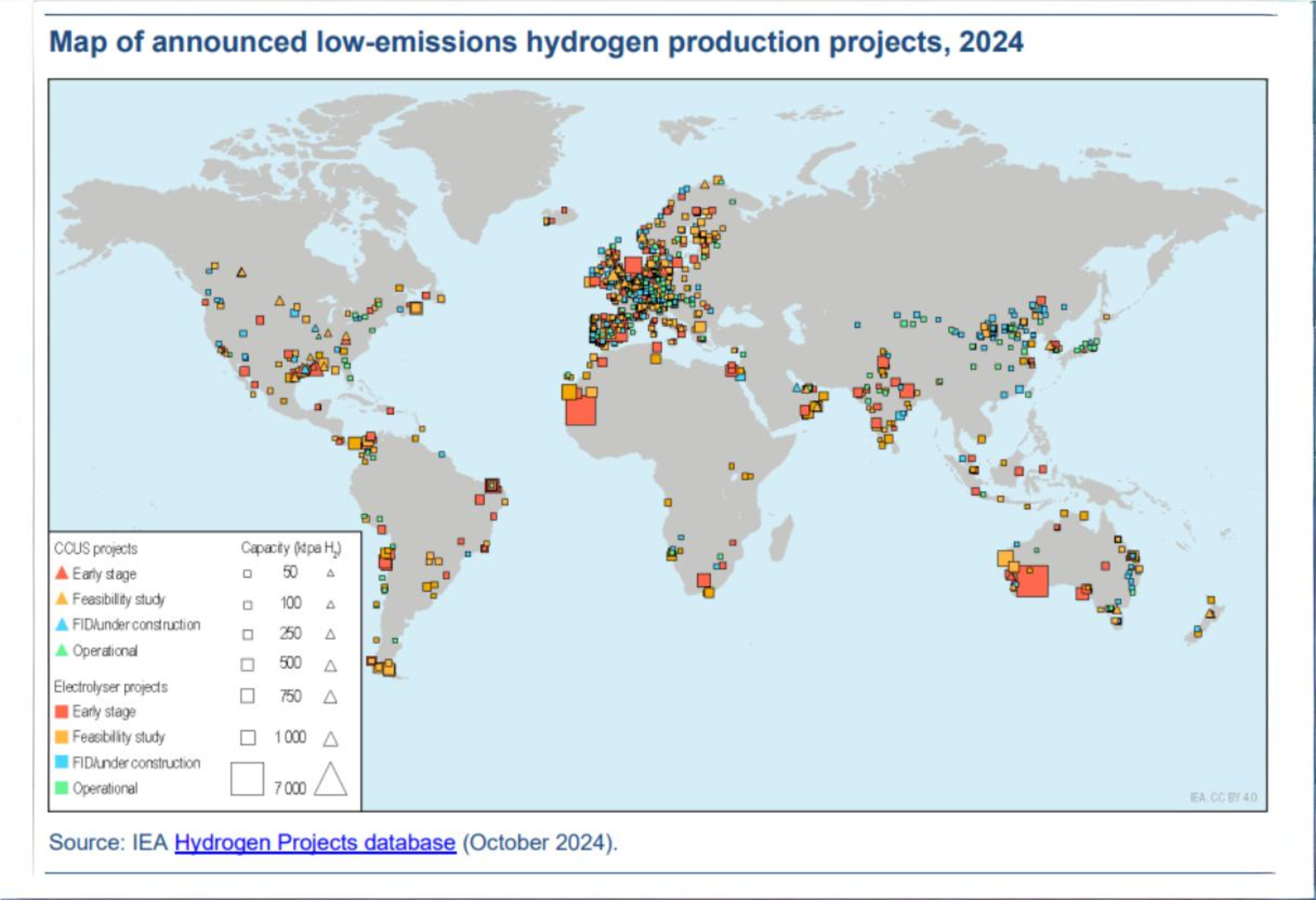

The report reveals that the number of projects reaching final investment decisions has doubled over the past 12 months, setting the stage for a fivefold increase in global low-emissions hydrogen production by 2030. Currently, the total global electrolyser capacity at the final investment decision stage stands at 20 gigawatts (GW).

If all announced projects are realised, global production could reach nearly 50 million tonnes per year by the end of the decade. However, this would require the hydrogen sector to grow at a compound annual growth rate of over 90%, far surpassing the growth rates experienced during the fastest phases of solar PV expansion.

China has emerged as a dominant player in the sector, accounting for more than 40% of the over 6 GW of electrolyser capacity that reached final investment decisions in the past year. China’s strength in mass manufacturing clean energy technologies, including electrolysers, has positioned it to control 60% of the global electrolyser manufacturing capacity, which now stands at 25 GW per year, significantly above the global average deployment rate.

Despite the increase in project announcements, installed electrolyser capacity and low-emissions hydrogen production volumes remain limited. Many developers are holding off on investments due to uncertainties around government support. A lack of clear regulatory frameworks and demand incentives means that much of the potential production remains in planning or early development stages, with larger projects facing delays or cancellations due to these hurdles, alongside permitting challenges and operational issues.

“The growth in new projects suggests strong investor interest in developing low-emissions hydrogen production, which could play a critical role in reducing emissions from industrial sectors such as steel, refining and chemicals,” said IEA Executive Director Fatih Birol.

Birol added, “But for these projects to be a success, low-emissions hydrogen producers need buyers. Policymakers and developers must look carefully at the tools for supporting demand creation while also reducing costs and ensuring clear regulations are in place that will support further investment in the sector.”

The report also highlights a significant gap between global production and demand targets. Governments have set production goals that total up to 43 million tonnes annually by 2030, but demand targets are significantly lower, at just 11 million tonnes. Some governments have already introduced policies aimed at stimulating demand for low-emissions hydrogen and hydrogen-based fuels, such as carbon contracts for difference and sustainable fuel quotas for aviation and shipping. These measures have begun to drive action on the industry side, leading to more agreements between producers and commercial consumers. However, progress in the hydrogen sector remains insufficient to meet global climate targets.

As a relatively new industry, low-emissions hydrogen continues to face cost pressures, particularly in electrolysis technology, which has seen setbacks due to rising prices and supply chain constraints. Achieving cost reductions will depend not only on technological advancements but also on optimising deployment processes and scaling up to mass manufacturing levels to secure economies of scale.

These cost reductions will benefit all projects, but the degree of impact will vary. For instance, hydrogen produced via electrolysis in China could become more cost-competitive than hydrogen derived from unabated coal by 2030, assuming the global electrolyser project pipeline of approximately 520 GW is completed. Industrial hubs where low-emissions hydrogen could replace current demand met by fossil fuel-based hydrogen remain a key, underutilised opportunity for governments to stimulate demand.