Organisations across the world are continuing to advance their sustainability efforts despite geopolitical challenges, with regulation and technology playing a pivotal role in driving progress. According to the Capgemini Research Institute’s latest report, ‘A World in Balance 2024: Accelerating Sustainability Amidst Geopolitical Challenges’, two-thirds of executives agree that their organisations cannot meet sustainability goals without the integration of climate technology.

This comprehensive report tracks the progress of organisations’ environmental and social sustainability initiatives over the past three years, revealing significant improvements in circularity, sustainable design, measurement, water stewardship, biodiversity, and sustainability skills, though challenges remain in addressing Scope 3 emissions and overcoming consumer skepticism.

The report highlights that organisations are steadily increasing their sustainability maturity, with 84% of executives this year stating that their companies are on track to meet carbon emissions targets, while fewer than 10% report being behind schedule. Progress is particularly evident in circularity, sustainable product design, measurement, and water management. Nearly three-quarters of executives report that recycling is a core component of their manufacturing strategies, up from 53% in 2022. Additionally, over two-thirds are redesigning products to eliminate fossil fuel-based materials, up from less than half in 2022. Water stewardship programs have also seen a notable increase, with three-quarters of executives now implementing these initiatives, compared to 55% in 2022.

Despite the initial intention to boost investments in sustainability in late 2023, companies have not fully followed through. The report notes that the average annual investment in sustainability initiatives now stands at 0.82% of total revenue, down from 0.92% in 2023.

“This year’s report shows sustainability projects continuing to build momentum in 2024 despite current headwinds,” said Cyril Garcia, Capgemini’s Head of Global Sustainability Services and Corporate Responsibility and Group Executive Board Member.

Garcia added, “Business leaders have the power and the responsibility to steer us towards a more sustainable economy. Water stewardship, biodiversity preservation, and circular practices are now established as key business imperatives. Executives are being very pragmatic, and CO2 reduction must now be translated into cost savings. We continue to see sustainability efforts bolstered by new climate tech innovations and regulations. The best way to build trust and credibility with consumers is by demonstrating tangible outcomes and planning for a future with sustainability at its heart.”

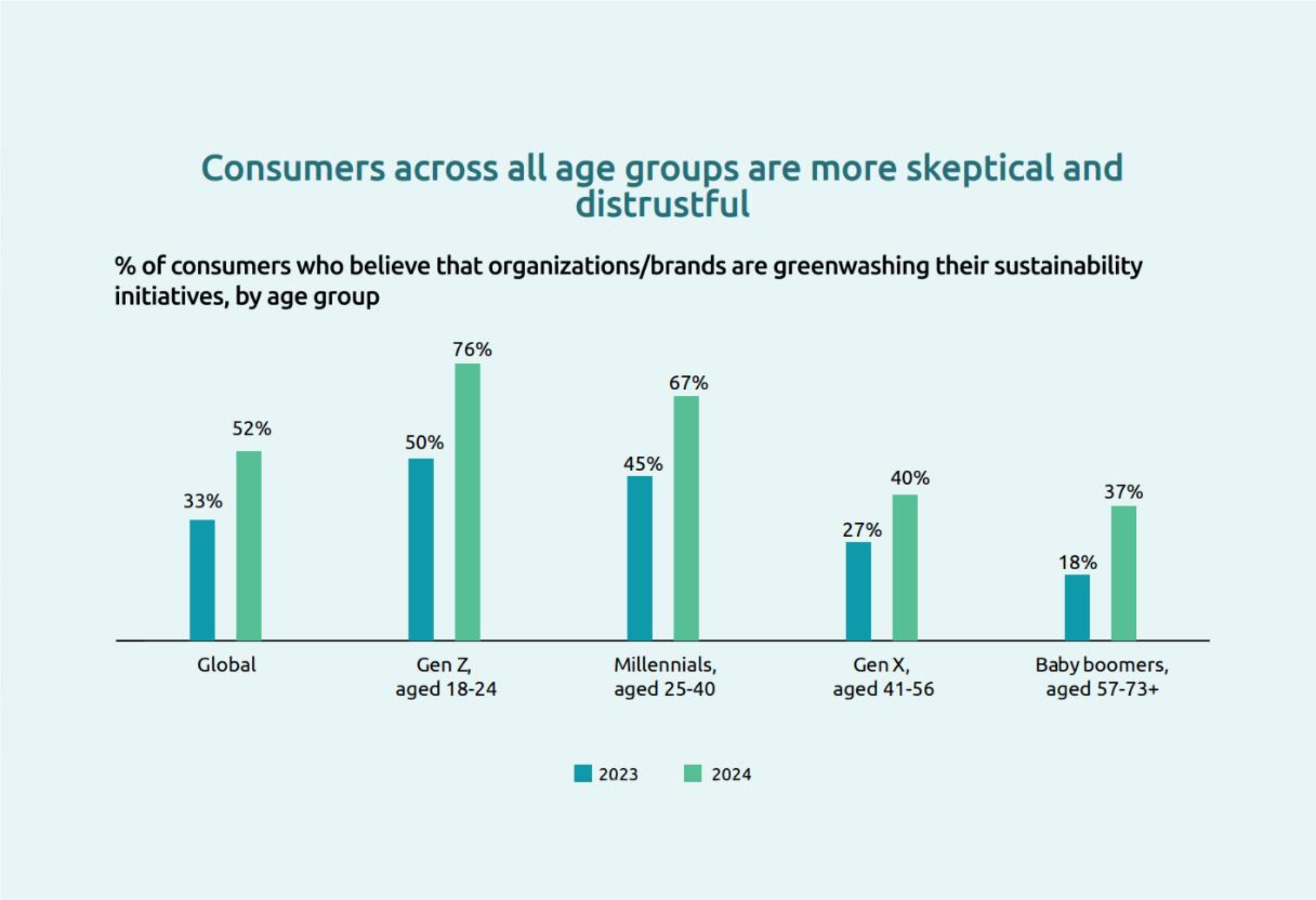

The report also sheds light on the growing consumer demand for transparency. Three-quarters of consumers expect corporations to take a more active role in reducing greenhouse gas (GHG) emissions in 2024. Despite organisations ramping up sustainability initiatives, consumer skepticism is on the rise, with more than half believing that companies are engaging in greenwashing, up from 33% in 2023.

The report underscores the role of climate-related regulations as a major driver of sustainability initiatives. Three-quarters of executives believe regulation is essential to achieving global climate goals, with nearly two-thirds agreeing that without regulation, their organisations would not have launched many environmental sustainability projects.

Globally, 73% of executives agree that the EU’s Corporate Sustainability Reporting Directive (CSRD) is sharpening sustainability measurement and tracking capabilities. However, many companies are still falling short in reporting on sustainability initiatives, particularly Scope 3 emissions. Among organisations required to report under CSRD by 2025, just over a third are prepared to report Scope 3 downstream emissions next year, while 86% are ready for Scope 1 reporting.

The Capgemini Research Institute conducted a survey in June and July 2024, gathering insights from 2,152 executives from 727 organisations, each generating over $1 billion in annual revenue. The survey spanned 13 countries across North America, Europe, and Asia-Pacific, covering 12 industries and sectors. Respondents were director level or higher, with 50% representing corporate functions such as strategy, sustainability, sales, and marketing, and the other 50% from value chain functions, including product design, R&D, procurement, and logistics. Additionally, the Institute surveyed 6,500 consumers aged 18 and above across the same countries and held interviews with 12 senior sustainability executives from leading global organisations.