A new report by the TPI Centre, based at the London School of Economics and Political Science, has assessed the climate ambitions of 26 major international banks, ten US super-regional banks, and two custodian banks, highlighting a significant disconnect between the climate targets set by these institutions and the policies they are implementing.

‘The State of Transition in the Banking Sector’ report reveals that despite setting climate goals, banks are still in the early stages of transitioning to low-carbon practices, with their current actions falling far short of what’s needed to meet global climate goals.

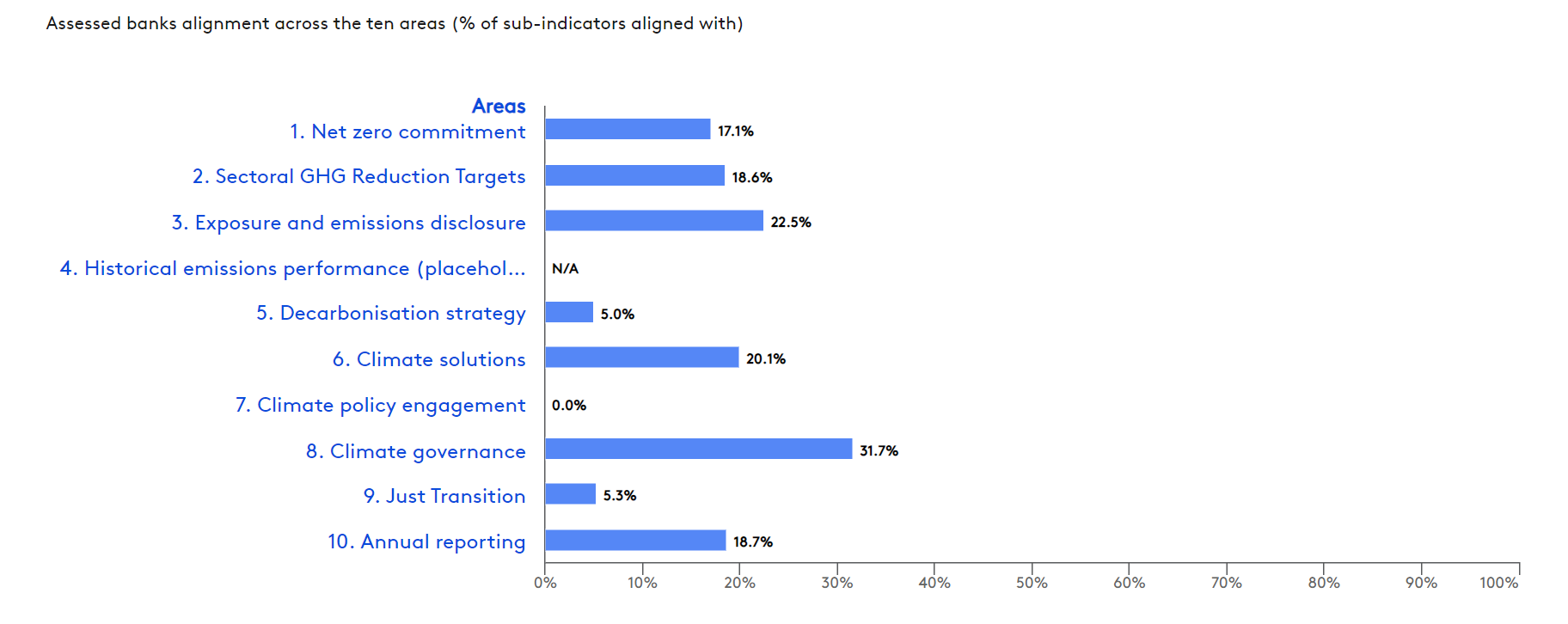

The report underscores a “stark reality” where the overall performance of the banking sector on climate initiatives is deemed “weak.” The authors note that while setting net-zero commitments has become a common practice, these commitments remain limited, as they exclude key business segments, especially capital market activities. The report estimates that banks’ current targets cover less than 22% of their total revenues, indicating a significant gap in their efforts.

While most banks acknowledge that climate risks could materially impact their businesses, very few integrate climate risk considerations into their financial statements. Additionally, banks are failing to disclose the proportion of climate finance relative to their total financing, making it difficult to assess their true commitment to climate goals.

The TPI Centre used its Net Zero Banking Assessment Framework (NZBAF), developed in consultation with investor networks such as the Institutional Investor Group on Climate Change (IIGCC) and Ceres, to assess banks’ progress. They evaluated banks’ Carbon Performance based on decarbonisation targets set for key sectors and their alignment with sectoral benchmarks for temperature goals of 1.5°C, below 2°C, and National/International Pledges over various timeframes.

The findings reveal that the vast majority of banks remain inconsistent with the Paris Agreement, with only 19% of sectoral pathways aligned with temperature goals of 1.5°C or below 2°C in the medium term (2028-2035). Furthermore, banks lack clear short- and long-term targets needed to map out a pathway to achieving net-zero emissions by 2050.

The analysis also shows disparities in climate commitments across regions. European and Japanese banks have set more sectoral decarbonisation targets than their North American counterparts, while Chinese banks have yet to set such targets. Among the top performers, Barclays, BNP Paribas, Groupe Crédit Agricole, HSBC, ING Bank, and JP Morgan Chase have the most targets, with BNP Paribas covering nine of the 14 high-emission sectors, and the others covering eight sectors each. However, significant variations remain among banks.

ING, Deutsche Bank, and JP Morgan Chase stand out with the highest number of targets aligned with temperature goals of 1.5°C and below 2°C in the medium term, each setting three targets. All three banks have focused their below-2°C targets on the electricity utilities sector.

The report also highlights that US super-regional banks are lagging in their climate commitments. Only one bank has pledged to reach net-zero financed emissions by 2050, and none have set sectoral decarbonisation targets. Additionally, only half of these banks have committed to scaling up climate finance with specific targets and milestones. Among US super-regional banks, only Fifth Third, Huntington Bancshares, and PNC disclose their absolute financed emissions, and only Truist discloses its exposure to all high-emission sectors.

Simon Dietz, Research Director at the TPI Centre and Professor of Environmental Policy, Department of Geography, LSE said, “While some progress has been made since our initial assessments in 2022, banks are not moving fast enough to meet global climate goals. Without stronger action, the banking sector exposes itself—and by extension, the global economy — to greater regulatory, market, and physical risks associated with climate change.”

Blair Bateson, Director of Financial Services for Ceres’ Company Network said, “Having a comprehensive and independent benchmark of banks’ climate progress is vital in moving the sector forward. Ceres looks forward to working with all the North American banks in the benchmark to help them catch up to global leaders.”

Lucia Graham-Wood, Senior Engagement Specialist, Banks, IIGCC said, “The TPI Centre’s independent analysis will provide useful insights that will help inform investors’ engagement with banks. We look forward to continuing to support members of the IIGCC’s Banks Engagement and Research Initiative on their ongoing climate-related engagements with banks in Asia, Canada and Europe. “