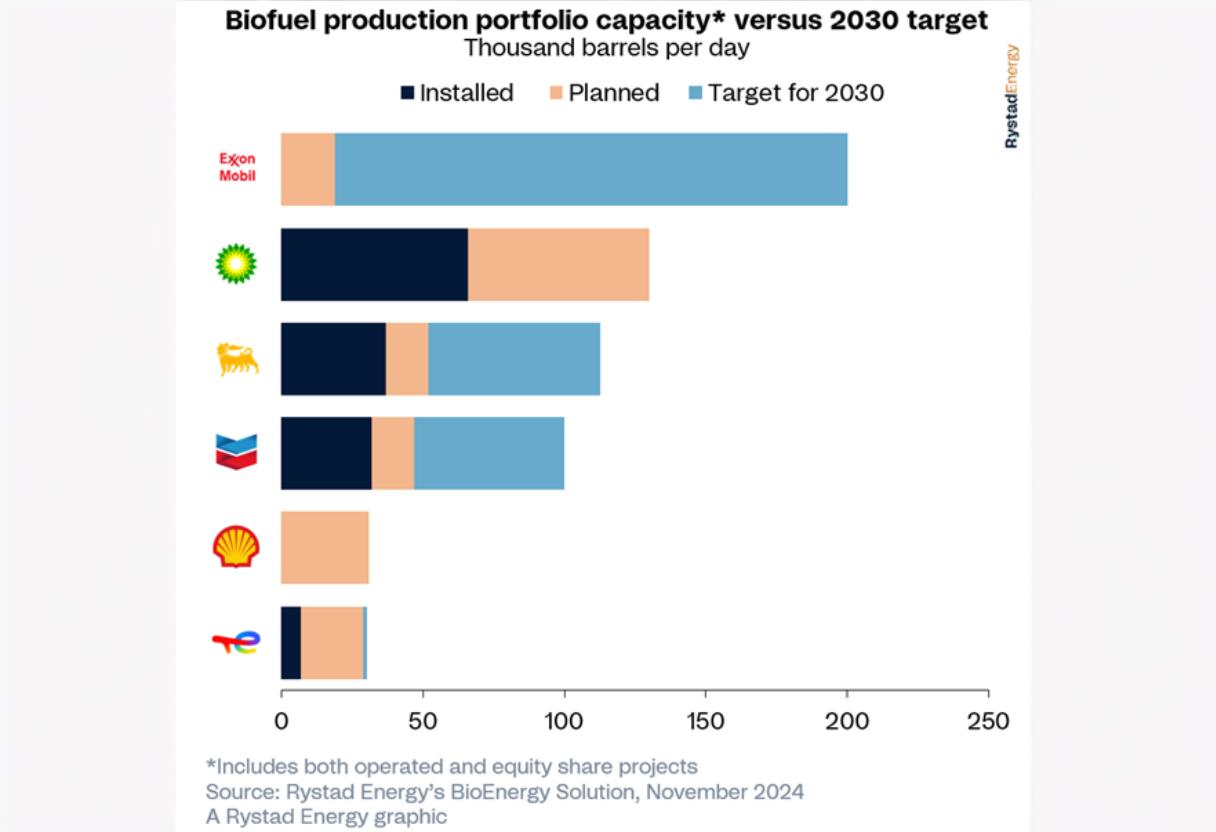

Global oil and gas giants are accelerating investments in biofuels as they transition to lower-carbon energy solutions, with 43 biofuel projects announced by BP, Chevron, Shell, TotalEnergies, ExxonMobil, and Eni slated to become operational by 2030. According to Rystad Energy, these projects aim to deliver a combined production capacity of 286,000 barrels per day (bpd), primarily focusing on hydrotreated vegetable oil (HVO) and sustainable aviation fuel (SAF), which are expected to comprise nearly 90% of the output.

Biofuels like HVO and SAF are considered pivotal to decarbonisation due to their compatibility with existing fuel systems in aviation, heavy transport, and marine sectors. Lars Klesse, an analyst at Rystad Energy, highlighted the growing importance of biofuels: “Supermajors are accelerating investments in biofuels like HVO and SAF, recognising their potential as low-carbon ‘drop-in’ fuels that can be swiftly integrated into existing aviation, heavy transport and marine fuel systems. As the energy transition progresses, these biofuels offer a practical, near-term solution to reduce emissions without requiring significant changes to current infrastructure. With increasing regulatory pressure to adopt SAF, such as Europe’s ‘ReFuel EU’ initiative and expanding mandates in Asia Pacific, biofuels have shifted from being a potential option to becoming an essential component of decarbonisation strategies.”

Among the 43 announced projects, 31 are greenfield developments, six involve co-processing—integrating bio feedstock into existing crude oil refineries—and six are full conversions of traditional refineries into dedicated biofuel production facilities. Co-processing has emerged as a cost-effective approach, leveraging existing infrastructure to minimise upfront investments and facilitating a smoother entry into the biofuels market for oil majors.

Among the projects, Chevron’s Geismar facility stands out as the largest greenfield development, projected to produce 22,000 bpd of biofuels. BP’s Kwinana project in Australia, the largest announced refinery conversion, is expected to add 50,000 bpd of HVO and SAF capacity by 2030. Meanwhile, Chevron’s El Segundo refinery, converted into a renewable fuel facility, currently produces 10,000 bpd.

BP has emerged as a frontrunner in the sector, targeting a production capacity of 130,000 bpd by 2030. The company’s acquisition of Brazilian biofuel producer Bunge Bioenergia has boosted its capacity to 66,000 bpd, surpassing its 2025 milestone of 50,000 bpd. Chevron and Eni are also scaling their biofuel operations, with Eni reporting an advanced biofuel capacity of 22,000 bpd driven by co-processing and refinery conversions.

TotalEnergies has outlined plans to use waste biomass for 75% of its biofuel production by the end of 2024, prioritising materials like used oils and animal fats to avoid land-use conflicts. ExxonMobil is set to launch biofuel production at its Strathcona Refinery next year, targeting an initial capacity of 20,000 bpd, with plans for 12 additional projects aimed at reaching 200,000 bpd by 2030.

The investments highlight the growing role of advanced biofuels in meeting global decarbonisation targets, particularly in sectors that are hard to electrify. Despite challenges and delays, oil majors are positioning themselves as leaders in biofuel production, ensuring their relevance in a rapidly evolving energy landscape. With rising regulatory demands and market opportunities, the focus on SAF and HVO is set to intensify, underpinning the industry’s efforts to transition to a sustainable energy future.