Vanguard, one of the world’s largest asset managers, has scaled back its board diversity guidance for US companies, marking a significant shift in corporate governance trends. The move aligns with regional variations in diversity, equity, and inclusion (DEI) policies and follows growing scrutiny of ESG investing under the Trump administration.

With $10.1 trillion in assets under management, Vanguard’s policy adjustments will be closely monitored as the 2025 shareholder meeting season begins in March.

The proxy voting policy no longer states that boards must include diverse personal characteristics such as gender, race, and ethnicity. Previous guidance had encouraged board composition to reflect a minimum level of gender and racial diversity.

Vanguard cited the UK corporate governance model, which expects 40% of board members to be women. The US lacks a federal requirement for board diversity, and Nasdaq has recently dropped efforts to mandate corporate diversity disclosures.

Vanguard emphasised that it has never imposed quotas and will continue to assess companies based on market standards. “We have never had quotas and look for boards to follow the listing standards of their respective markets,” said John Galloway, Vanguard’s global head of investment stewardship.

The revision comes at a time when corporate America is facing increasing pressure to roll back DEI initiatives. Since taking office on 20 January,President Donald Trump has issued multiple executive orders aimed at dismantling corporate diversity and ESG policies.

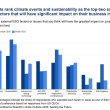

Despite this, investor sentiment remains strong in favour of DEI policies. A recent shareholder vote at Costco saw 98% of investors reject an anti-DEI resolution on 23 January.

Boardrooms have become more diverse since the Black Lives Matter movement of 2020, but the pace of change is slowing. Many companies have already met initial diversity targets and are now focusing on other hiring priorities.

BlackRock, a key Vanguard competitor, recently removed its 30% board diversity target, stating that 98% of S&P 500 companies already meet this benchmark. Republican officials have accused Vanguard and BlackRock of over-prioritising ESG policies at the expense of shareholder returns.

Vanguard has been adjusting its approach to ESG investing. In 2023, it did not support any of 400 environmental or social shareholder resolutions in the US. The new proxy voting policy has also removed examples of social and environmental resolutions it might support.

“We’re trying to provide clarity to people who have concerns, whether they are pro-ESG or anti-ESG,” said Galloway.