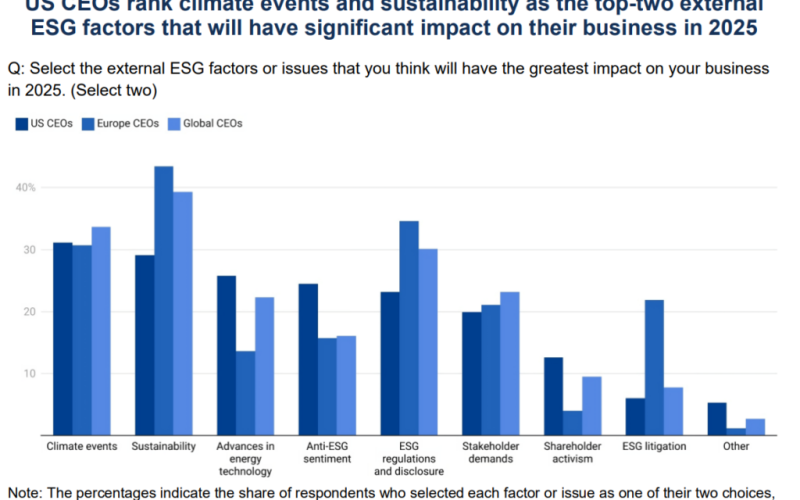

As businesses enter 2025, US CEOs are prioritising climate risk, sustainability, and regulatory challenges as they navigate the evolving environmental, social, and governance (ESG) landscape. A new report from The Conference Board, C-Suite Outlook 2025: Seizing the Future, highlights the top ESG priorities for corporate leaders in the US, Europe, and globally. While climate resilience and sustainability remain key concerns, business leaders also face increasing pressure from regulatory complexities and shifting societal expectations.

According to the report, climate risk and sustainability rank as the two most critical ESG factors likely to impact US businesses this year. The growing frequency of extreme weather events, such as wildfires and hurricanes, has made climate risk a significant concern for corporate strategy. In 2024 alone, the United States experienced 27 climate disasters, each causing more than $1 billion in damages. This follows a record 28 such events in 2023. In January 2025, devastating wildfires in Los Angeles underscored the ongoing risks. As a result, an increasing number of companies are recognising climate change as a material risk, with 84% of S&P 500 firms and 64% of Russell 3000 companies now identifying it in their risk disclosures—up from 67% and 30% in 2021, respectively.

While sustainability is a long-term strategic priority for many US CEOs, the immediate and tangible impacts of climate events demand urgent action. This contrasts with European counterparts, where sustainability leads the corporate agenda, largely due to stronger regulatory drivers such as the Corporate Sustainability Reporting Directive (CSRD) and broader societal consensus on climate goals. Globally, both climate risk and sustainability are key concerns for CEOs and board members, with energy technology advancements ranking as a critical area of focus in the US due to their role in reducing climate risks, lowering costs, and improving energy security.

The increasing complexity of ESG regulations presents another major challenge for US businesses in 2025. While ESG regulations rank fifth among external ESG issues for US CEOs, they remain a significant concern. The evolving policy landscape, particularly at the state level, is creating compliance difficulties. For example, California has introduced extensive climate disclosure laws that will require businesses to report on emissions and sustainability efforts. However, under the new federal administration, the Securities and Exchange Commission’s (SEC) proposed enhanced climate disclosure rules—which would have mandated publicly listed companies to disclose material climate risks, targets, and emissions—are unlikely to proceed. This leaves US sustainability reporting fragmented, with larger firms navigating overlapping obligations from state laws and international frameworks like the CSRD. Globally, the shift from voluntary to mandatory sustainability reporting is accelerating, with Europe setting a benchmark through the CSRD, and many jurisdictions aligning with the International Sustainability Standards Board (ISSB).

A uniquely American challenge in the ESG landscape is the rise of anti-ESG sentiment, which ranks as the fourth most significant external ESG issue for US CEOs in 2025. This is in stark contrast to Europe and other global markets, where ESG remains largely uncontroversial. The growing opposition to ESG initiatives in the US has been driven by political and legal scrutiny, particularly regarding corporate involvement in social and environmental issues. State-level restrictions on ESG investments, legal challenges against ESG-aligned policies, and public criticism of corporate sustainability efforts have further deepened divisions. Despite this, business leaders remain committed to advancing ESG strategies, focusing on aligning sustainability initiatives with long-term financial performance and shareholder value.

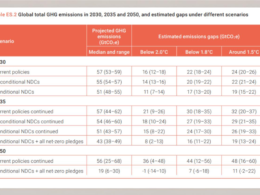

Renewable energy and carbon neutrality remain universal ESG goals, though their emphasis differs across regions. In Europe, stringent decarbonisation policies under the European Green Deal and CSRD are creating immediate pressure for businesses to accelerate their transition to clean energy. By contrast, the US federal approach to climate policy remains inconsistent, with significant variations at the state level. However, recent federal investments in renewable energy and clean technology, along with declining costs and energy security considerations, continue to drive momentum for renewables. Despite the likelihood of increased fossil fuel production under the new administration, state-led initiatives and corporate commitments to international climate goals will sustain near-term progress toward net-zero targets. Notably, nearly 90% of the largest US public companies have already set climate targets, such as achieving net-zero emissions by 2050.

Climate resilience and water management have emerged as the top environmental priorities for US CEOs, surpassing renewable energy and carbon neutrality. This reflects the increasing urgency of addressing extreme weather risks, rising property damage costs, and growing scrutiny over corporate water usage. In 2025, businesses are expected to focus on strengthening infrastructure resilience, improving water efficiency, and integrating climate risk management into long-term strategic planning. Water scarcity, particularly in regions like the US Southwest, has become an increasingly pressing issue, with companies facing pressure from both investors and consumers to adopt more sustainable water management practices.

The circular economy, which emphasises reducing waste and promoting recycling, is also gaining traction among US businesses, although it ranks lower as a priority compared to Europe. While European CEOs place a greater emphasis on circular economy initiatives due to regulatory mandates and cultural alignment, US firms are gradually increasing their focus on waste reduction and resource efficiency. Progress has been made, with a growing number of American companies adopting sustainability strategies that align with global supply chain demands and international reporting standards like the CSRD.

Beyond environmental concerns, economic opportunity and education remain the top social priorities for both US and global CEOs. The ongoing workforce transformation has increased the demand for upskilling and reskilling initiatives, with businesses investing in partnerships with educational institutions to develop targeted training programs, apprenticeships, and certifications. In particular, high-demand sectors such as STEM, digital technology, and advanced manufacturing are seeing greater corporate involvement in workforce development. Additionally, companies are looking to expand economic opportunities by supporting supplier diversity, funding infrastructure projects, and fostering job creation in underserved communities.

Labour conditions and working rights continue to be a greater focus in Europe than in the US, largely due to stronger regulatory oversight and cultural expectations. European CEOs rank fair wages, worker safety, and ethical supply chain practices as top concerns, while US leaders tend to prioritise economic opportunity and education. However, growing consumer and investor pressure is driving American firms to improve labour transparency and accountability, particularly in response to international regulations like the Corporate Sustainability Due Diligence Directive (CSDDD), which affects non-EU firms with European operations.

In the US, gender equality remains a significant corporate priority, ranking fourth among social concerns for 2025. However, racial and ethnic equality has fallen from fourth to sixth place, reflecting a shifting environment for corporate diversity, equity, and inclusion (DEI) initiatives. Increasing legal challenges to affirmative action, state-level restrictions on DEI programs, and the rollback of diversity-related disclosure rules have led some companies to adjust their DEI strategies. While most firms remain committed to diversity in leadership and pay equity, many are now reframing their DEI messaging to mitigate political and legal risks.

As US businesses navigate the evolving ESG landscape in 2025, proactive management of climate risks, regulatory adaptation, and strategic sustainability investments will be crucial for long-term resilience and competitiveness. While political and regulatory uncertainties persist, corporate leaders are expected to maintain their focus on ESG as a key component of risk management, value creation, and global market positioning.