In the final quarter of 2024, Article 8 environmental, social, and governance (ESG) open-end and exchange-traded funds (ETFs) attracted €52 billion ($54 billion) in net inflows in the Europe Union, according to Morningstar. This marks the highest quarterly intake of the year and the largest since late 2021.

Under the EU’s Sustainable Finance Disclosure Regulation (SFDR), funds are classified as Article 6, 8, or 9 based on their sustainability credentials. Article 8, or “light green” funds, promote environmental and social characteristics, while Article 9, or “dark green” funds, have a sustainable investment objective. According to Morningstar data, Article 6 funds, which do not meet these criteria, continued to dominate the market, securing €85 billion ($88.6 billion) in net subscriptions during the fourth quarter.

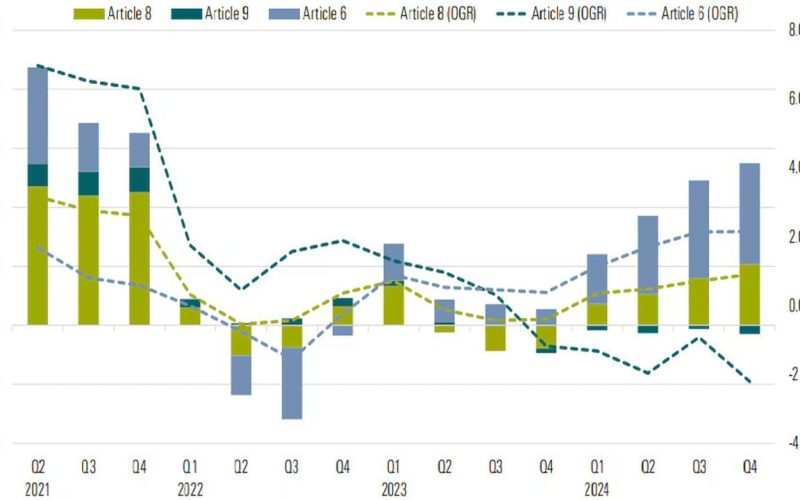

Meanwhile, redemptions from Article 9 funds persisted for a fifth consecutive quarter, with investors pulling out a record €7.3 billion ($7.6 billion), compared to €3 billion ($3.2 billion) in the previous quarter. Investor sentiment towards Article 8 and 9 funds remained mixed throughout the year, shaped by high interest rates, geopolitical tensions, greenwashing concerns, and regulatory uncertainties.

Fixed-income funds emerged as the primary beneficiaries of Article 8 inflows, as subdued inflationary pressures and expectations of modest rate cuts made bonds an attractive investment. In contrast, equity funds in both the Article 8 and 9 categories saw net outflows, as investors in the 2024 bull market favoured conventional equity strategies.

Actively managed Article 8 funds continued their recovery, recording €36.3 billion ($37.8 billion) in net inflows—their best quarter since late 2021. Passive Article 8 funds also saw steady growth, drawing €15.7 billion ($16.3 billion) in investments.

Total assets in Article 8 and 9 funds climbed to a record €6.1 trillion ($6.4 trillion), representing 60% of the EU fund market. This increase was partly driven by continued fund reclassifications from Article 6 to Article 8 or 9.

Passive investment strategies expanded further, accounting for 12.5% of Article 8 assets and nearly 17% of Article 9 assets. The growing demand for ESG exchange-traded funds (ETFs) and index funds contributed to this trend, with sizeable funds tracking Paris-aligned and climate-transition benchmarks leading the growth.

Fund rebranding activity accelerated in 2024, with more than 170 Article 8 and 9 funds changing names during the year, including at least 65 in the final quarter. This shift aligns with upcoming guidelines from the European Securities and Markets Authority (ESMA), which aim to mitigate greenwashing risks by enforcing stricter standards on ESG-related fund names.

Industry analysts expect between 30% and 50% of EU ESG funds—equating to 1,200 to 2,200 funds—to undergo name changes in the coming months. These changes will include the removal, addition, or modification of ESG-related terms, as well as fund mergers, particularly among smaller and underperforming products.

For some asset managers, the ESMA guidelines have prompted a full-scale review of fund offerings, with certain firms adjusting the sustainability characteristics of their portfolios to comply with stricter ESG criteria. Funds using terms like “sustainable” or “ESG” may face the most significant revisions, especially as fossil fuel exclusions become mandatory under the Paris-aligned benchmark regulations.

The ESG fund landscape is also witnessing a shift towards climate transition strategies, with investors increasingly seeking to align their portfolios with real-world decarbonisation goals. Several funds have already rebranded to reflect this trend, including Templeton European Sustainability Improvers (previously Templeton European Dividend), Allspring Climate Transition Global Equity (formerly Allspring 2 Degree Global Equity), and Man Global Climate Transition Impact Bond (formerly Man Global Climate Impact Bond).