Winning Gold for Asia’s Best Sustainability Report (Governance) at the 11th ASRA marks a turning point for KGI Life Insurance Co., Ltd. Chief Sustainability Officer Helen Chen shares how the company has moved “from compliance requirements to a tool for strategic communication,” aligning global frameworks, quantified data, and board oversight to embed sustainability into everyday business decisions.

Congratulations on winning at the 11th Asia Sustainability Reporting Awards. What does this recognition mean for your sustainability team and your organisation?

First of all, we are truly grateful to ASRA for this prestigious recognition. In 2024, KGI Life completed its rebranding, marking a significant milestone in our development. This award affirms our progress in strengthening sustainability governance and motivates us to stay the course as we move steadily towards our goal of achieving net-zero carbon emissions across our entire investment portfolio by 2045.

This honour also recognises the efforts of our sustainability team in upholding the transparency and accuracy of our disclosures. KGI Life proactively aligns with global frameworks, such as the UN Principles for Responsible Investment (PRI) and the Principles for Sustainable Insurance (PSI). Our reporting adopts GRI, SASB, and TCFD standards, demonstrating our readiness to engage with international capital markets.

Sustainability has become an integral part of KGI Life’s corporate DNA. From board decisions to frontline business, the entire organisation is mobilised to embed sustainable value through our core competencies. In 2025, we received several awards, including the National Enterprise Environmental Protection Award from the Ministry of Environment, the “Green Leadership” award at the Asia Responsible Enterprise Awards (AREA), and were recognised by CommonWealth Magazine as the only Taiwanese life insurer selected for two consecutive years for meeting the “1.5°C Target”—reflecting our balanced performance across environmental, social, and governance dimensions.

Sustainability reporting has evolved rapidly. How has your reporting approach matured over the past few years, and what were the biggest lessons from this journey?

Over the past few years, KGI Life’s sustainability reporting has undergone a transformation—from compliance requirements to a tool for strategic communication. Our progress has been most visible in three areas: more structured data, greater alignment with international frameworks, and an institutional governance approach.

First, on data, we no longer rely mainly on qualitative descriptions. We focus on precise, measurable metrics. For example, we have completed ISO 14064-1 verification for greenhouse gas inventories across all operating sites, and we have also adopted the PCAF methodology to calculate financed emissions for our Scope 3 emissions—emissions contributed by our investment and financing positions. This enables us to understand our portfolio carbon footprint more accurately and plan a science-based reduction pathway (SBT).

Second, on frameworks, starting in 2025 we began introducing the IFRS S1 and S2 to better align sustainability information with financial information, improving the applicability of our disclosures to investors’ decision-making.

In addition, we are honing our skills in data governance. A high-quality report is not produced solely on the basis of information collected by the sustainability department at the end of each year. Instead, it requires a regular internal control and data collection system. That is why we established internal controls for sustainability information management and incorporated climate risk into our ORSA framework. In our view, a sustainability report is not only a scorecard—it’s a powerful driver for upgrading internal controls and management.

The ASRA judges emphasise rigour, transparency, and impact. Which parts of your report do you feel best demonstrate these qualities?

On rigour, we apply the highest standards to data accuracy. For instance, we conducted an ISO 14067 carbon footprint assessment for the insurance service lifecycle, calculating the service carbon footprint per policy at 2.619 kg and obtaining a carbon label certificate from the Ministry of Environment. Third-party verifications have laid a solid foundation for our commitment to carbon reduction. In addition, our sustainability report is disclosed only after review by the Board, reinforcing internal control over sustainability information and quality.

On transparency, we issued a standalone TCFD report that goes beyond listing climate risks—it also discloses scenario analysis results, including the potential financial impacts on our portfolio under NGFS orderly and disorderly transition scenarios. We even disclose the logic behind our internal carbon pricing (shadow price), setting our operational carbon price at NT$3,990 per tonne to demonstrate our commitment to low-carbon operations.

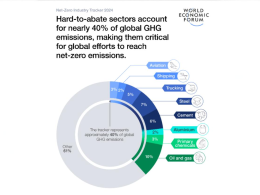

On impact, we set the goal of achieving net-zero carbon emissions across our entire investment portfolio by 2045, and we committed that, from 2025, we will stop making new investments in thermal coal and unconventional oil and gas. By the end of 2024, our green and sustainable investment balance reached NT$44.8 billion—up 45.7% from 2022—demonstrating how we use financial influence to drive low-carbon transition across the value chain.

Could you walk us through the process of materiality assessment — and how you are now integrating double materiality or value-chain impacts into your reporting?

Our materiality assessment is rigorous and comprehensive. Following the GRI 3 standard, we apply a four-step approach: identifying impacts, identifying topics, assessing impacts, and reporting. The core principle is that we look not only at how sustainability issues affect our financial performance, but also at how our operations affect the environment and society—this is the essence of double materiality.

We begin by reviewing our own operations and the topics that peers in Taiwan and internationally are focusing on, identifying 24 topics. We then survey internal and external stakeholders, and conduct quantitative assessments across two dimensions: impact materiality (the degree of impact on the external economy, environment, and people) and financial materiality (the degree of potential financial impact).

Notably, under the material topic of “practise sustainable finance,” we disclose not only our investment decision-making process, but also the proportion of investments in high-carbon sectors, the sustainability performance of our portfolio, and our engagement with investee companies—so the report can faithfully reflect our responsibilities and impacts across the value chain.

How do you ensure data accuracy and credibility across complex topics such as GHG emissions, supply-chain sustainability, and human rights?

Data credibility is the foundation of sustainability reporting. For complex ESG topics, we use a dual assurance approach: standardised methodologies plus third-party assurance.

For GHG emissions, we followed ISO 14064-1 to make an inventory covering 100% of our operations, and all results were verified by a third party. For the most challenging area—Scope 3 financed emissions—we use the PCAF methodology and conduct semi-annual estimates across six investment asset classes to ensure international comparability and credibility.

For supply-chain sustainability, we have strict screening and management mechanisms. Suppliers are required to sign a Supplier Sustainability Responsibility Commitment, and we conduct human rights risk and ESG due diligence on key suppliers. In 2024, the response/recovery rate reached 100%, and we have been recognised for four consecutive years by the Executive Yuan’s Ministry of Environment as a top-performing green procurement enterprise.

For human rights, we have a clear human rights policy and incorporate related indicators into due diligence. In our investment process, we review whether target companies are involved in human rights violations and incorporate such companies into the negative screening list. In addition, our reports undergo limited assurance by Deloitte Taiwan under ISAE 3000, providing a solid base for our non-financial disclosures.

What new sustainability frameworks (for example, ISSB or TNFD) are you preparing to align with, and what challenges or opportunities do they bring?

KGI Life has consistently worked at the forefront of aligning with international standards. We are actively adopting the ISSB’s IFRS S1 and S2 sustainability reporting standards, and we are also closely monitoring the development of TNFD because we recognise the importance of biodiversity protection.

The biggest challenges these frameworks bring are data granularity and financial relevance. IFRS S2 requires more specific climate resilience assessments and more quantified financial impact analysis, which means we must adopt more complex and precise scenario analysis models.

At the same time, these challenges create opportunities. Aligning with IFRS S1 and S2 helps companies identify how climate risks may affect financial statements earlier and optimise asset allocation. It can also help uncover new business opportunities—for example, expanding investment in renewable energy to meet transition needs. By aligning with these rigorous frameworks, we strengthen risk resilience and demonstrate the vision expected of a leading life insurer in Taiwan.

Reporting aside, which sustainability initiative or achievement from the past year are you personally most proud of?

Setting aside the report’s data and frameworks, what I’m most proud of is our tangible progress in financial inclusion and fair customer treatment. In 2024, our target achievement rate for microinsurance reached 256%, ranking first in the industry and benefiting more than 100,000 people—meaning we truly extended protection to those who need it most.

We are also the first life insurer to introduce a policy Braille identification service, and we include a QR code with audio guidance for “Important Rights and Interests” on policies. These considerate measures respect visually impaired policyholders by helping them understand their rights and interests independently. These actions go beyond compliance and reflect our customer-centric philosophy.

In addition, I’m proud of our culture of volunteering. Our sustainability actions are consistent from top to bottom: our Chairperson and President volunteered in fraud prevention campaigns for rural and elderly communities. By the end of October 2025, volunteer service hours totalled 34,068; average volunteer hours per employee were 14.24; and our achievement rate was 203.43%.

How do you engage internal teams and business units in the sustainability agenda so that reporting reflects genuine performance, not just compliance?

To make sustainable development a corporate culture rather than a responsibility shouldered by one department, the key is the combination of governance, performance alignment, and organisation-wide capability building. At KGI Life, we don’t want sustainability to be about “submitting a report”—we want every colleague to feel the relevance.

First, we have built a strong governance structure. Under the Sustainable and Ethical Management Committee supervised by the Board, we have six task forces—corporate governance, social welfare, environmental sustainability, responsible finance, customer rights and interests, and employee care—each led directly by the head of the relevant function.

More importantly, we incorporate ESG indicators into annual performance evaluations for senior executives and relevant departments. This means that carbon reduction goals and financial inclusion initiatives are not slogans—they are KPIs that directly affect compensation and bonuses, ensuring cross-functional commitment.

Finally, we focus on building sustainability capability. We provide financial support and encourage employees to take the Basic Test on Sustainable Development. As of the end of October 2025, nearly 1,300 employees (54%) had passed. I’m proud to say every department at KGI Life is equipped with sustainability talent.

Many companies are still struggling to link sustainability KPIs with business results. How has your organisation made that connection visible in its strategy and disclosures?

To turn sustainability KPIs into business value, we see ESG as risk management and investment opportunity—not simply as a cost. We work to make the linkage visible through clear quantitative metrics and financial relevance analysis.

For example, through scenario analysis in our TCFD report, we quantify the probable maximum loss that insurance products could face from climate-related natural disasters such as typhoons and hurricanes, and communicate with stakeholders in financial terms. In 2024, our total green and sustainable investments reached NT$44.8 billion, 45.7% higher than the 2022 baseline. This not only supports decarbonisation but also creates long-term, stable returns—proving that low-carbon transition and profitability can progress together.

This kind of disclosure—directly mapping ESG indicators to revenue, cost, and risk—makes the connection between sustainability and business outcomes clear and tangible.

In 2024, KGI Life not only maintained stable financial growth but also incorporated sustainability into insurance services and operations. From microinsurance to innovation in accessible and inclusive financial services, we are committed to our promises to stakeholders and to creating sustainable value for society.

Finally, what advice would you give to other sustainability professionals aspiring to reach ASRA-winning standards in their reports?

My first piece of advice is accountability. A sustainability report shouldn’t be about media exposure or brand image—it must be built on robust data and governance. Use internationally recognised standards and obtain third-party assurance. Define boundaries clearly and be transparent about methodologies. Trust is earned through faithful disclosures.

Second is relevance. Don’t treat ESG topics as separate silos. Show how they connect to the company’s core business strategy. Tell a complete value-creation story—how capital is used to create social value while also delivering returns to shareholders.

Third is vision. Don’t stop at last year’s performance. Stakeholders care not only about what has been done, but also how the company plans to respond to future challenges. Set clear short-, medium-, and long-term targets—such as an SBTi-aligned decarbonisation pathway—and demonstrate credible plans.

In short, a high-quality sustainability report should function as a strategic map for sustainable management: focus on real-world impact, maintain transparency and integrity, and recognition will follow.