Africa’s climate finance landscape has experienced growth, with total flows reaching $44 billion in 2021-2022, a 48% increase from $30 billion in 2019-2020, according to the ‘Landscape of Climate Finance in Africa 2024’ report by Climate Policy Initiative (CPI) and commissioned by FSD Africa. However, the report highlights that this progress is insufficient to meet Africa’s climate adaptation and mitigation needs, revealing a significant financing gap that could have severe social and economic consequences.

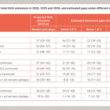

Despite the increase in private sector climate finance, which doubled to $8 billion, private funding still only constitutes 18% of Africa’s total climate flows, a far lower share than other regions globally. Public finance remains the primary source, accounting for 82% of total flows. The report identifies low domestic contributions, with just 10% of total climate finance coming from domestic actors, 75% of which is private. Regional imbalances are evident, with the top ten countries receiving 50% of total finance, while the bottom 30 receive only 10%. South Africa, Egypt, and Nigeria alone account for half of all private flows. Debt financing, making up 36%-43% of flows, remains prevalent, even in debt-distressed countries, despite significant grants.

The report highlights that Africa currently meets only 23% of its estimated annual requirements for implementing Nationally Determined Contributions (NDCs) and achieving 2030 climate goals. Contributions from African governments have declined due to fiscal constraints, falling from $1.6 billion in 2019/2020 to $1 billion in 2021/2022.

To address the financing gap, the report recommends strengthening enabling environments with green fiscal incentives, improving coordination between investors and development financiers, integrating climate and development objectives into national policies, and maximising business opportunities for green growth through concessional finance. It emphasises mobilising more domestic and international private capital, leveraging Africa’s domestic green bond markets, and making climate adaptation a commercial opportunity for the private sector.

Mark Napier, CEO of FSD Africa said, “Climate change has the potential to cause Africa major and unprecedented economic disruption and reverse gains made in the recent past. To counter that, all actors must invest in a more sustainable future. Climate finance is the key element that will determine Africa’s ability to adapt to, mitigate, and develop through, a changing climate. This report by the CPI provides policymakers and decision-makers on the continent with a survey of the climate finance landscape as it is now, and as it can – and must – develop in the future.”

Barbara Buchner, Global Managing Director of CPI added, “It is encouraging to see more climate finance flows in Africa, but the rate of growth is too slow. Public policy and investment must be targeted effectively, and private capital, both domestic and international, can no longer sit on the sidelines. Otherwise, the significant economic opportunities currently available across the continent will be overshadowed by severe economic losses and catastrophic social consequences.”