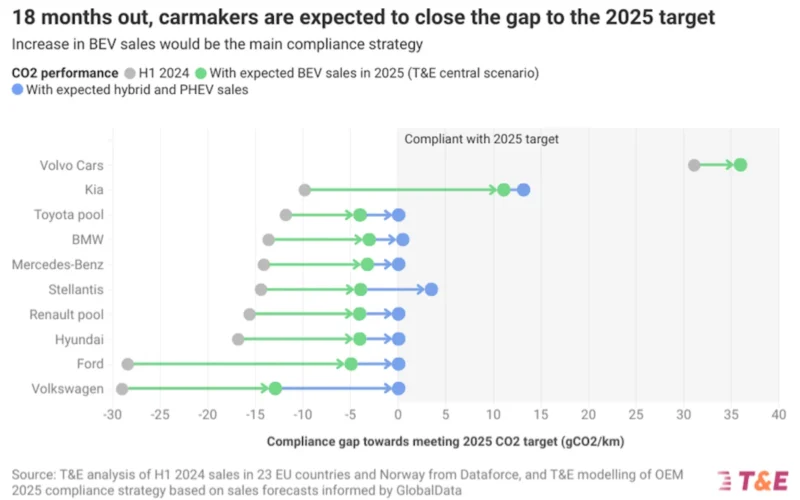

Car manufacturers are set to meet their EU climate targets next year due to the expected surge in electric vehicle (EV) sales, according to a new analysis by Transport & Environment (T&E). Battery electric vehicles (BEVs) are projected to reach a market share of 20-24% by 2025, based on sales data from the first half of 2024 and forecasts for the upcoming years.

Despite some manufacturers urging the EU to delay CO2 targets due to concerns about sluggish EV sales, T&E’s analysis shows that BEVs will account for 60% of the CO2 reduction required for automakers to meet their EU emissions targets next year. This progress will be bolstered by the arrival of seven new fully electric models priced under €25,000, which are expected to hit the market in 2024 and 2025.

Lucien Mathieu, cars director at T&E said, “2025 will be a great year for Europeans in the market for an electric car. BEVs should be almost a quarter of new cars sold thanks to a glut of new, more affordable models. But manufacturers’ reliance on hybrids, which are reaching the limits of their CO2 saving potential, is a short-sighted strategy for the climate and competing with Chinese BEVs.”

While BEVs will play a key role in meeting emissions targets, automakers like Stellantis and Volkswagen Group are expected to rely heavily on hybrids (HEVs) for 33% and 30%, respectively, of the CO2 reductions needed to hit their targets, according to T&E’s modeling, based on data from market research firm GlobalData. Hybrid sales will also be crucial for Mercedes-Benz (17%) and Renault (15%) in closing their emissions gaps. BMW, in particular, is expected to rely on plug-in hybrids for 18% of its emissions cuts.

If manufacturers lean more on hybrid sales to comply with regulations, the overall BEV market share would drop to 20% next year, compared to the 24% forecast in T&E’s central scenario. Regardless of these fluctuations, Volvo Cars is already on track to meet its 2025 targets due to strong BEV sales.

In cases where manufacturers fall short of meeting targets, they can form “pools” with other carmakers to collectively reduce their average emissions. For instance, if Volkswagen pools with Tesla, it would only need 17% of its sales to be BEVs, down from 22%. Similarly, if Ford teams up with Volvo, as it did in 2021, it would need just 9% of its sales to be BEVs, compared to 21%.

In July, European Commission President Ursula von der Leyen reaffirmed the EU’s goal of achieving zero-emissions cars by 2035. Last week, the German government rejected calls from the auto industry to weaken the 2025 CO2 targets. T&E is urging EU and national policymakers to further support EV adoption through measures such as corporate fleet electrification targets, national charging infrastructure plans, and social leasing schemes.

Lucien Mathieu said, “We welcome that President von der Leyen and the German government have put an end to uncertainty over the car CO2 targets. Now it’s time for the EU to support electric car uptake by setting electrification targets for corporate fleets. Governments need to build a stable regulatory environment for EVs with national charging goals and targeted support for buyers.”