Canadian nuclear fusion startup General Fusion, which counts Amazon founder Jeff Bezos among its backers, is appealing for additional investment to complete its flagship demonstration project. Despite raising over $300 million to date, the company says it is struggling to move forward due to the current economic and geopolitical climate.

“We are ready to execute our plan but are caught in an economic and geopolitical environment that is forcing us to wait,” Chief Executive Greg Twinney wrote in an open letter. “All we need now is the capital to finish the job.”

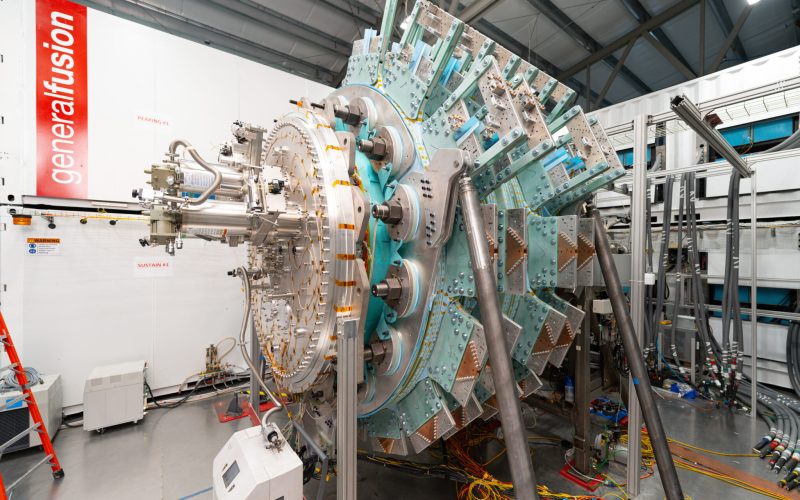

The company, which aims to develop a commercial fusion energy system, is currently exploring options with investors, buyers, and governments. A spokesperson confirmed that General Fusion has laid off at least a quarter of its staff and scaled back operations due to a funding shortfall. It is now seeking an additional $125 million to complete its fusion demonstration system.

Economic uncertainty and growing political tensions — including those affecting US-Canada trade — have made investors and public funders more cautious, slowing progress, the company said.

Fusion energy gained momentum in 2022 when a US lab achieved a breakthrough by generating more energy from a fusion reaction than was used to start it. However, turning fusion into a reliable energy source remains a significant engineering challenge. General Fusion announced a key milestone in April but still faces major hurdles in completing its system.

Bezos has participated in several previous funding rounds. Last month, General Fusion brought on board the former CEO of Bezos’s space venture, Blue Origin, as a strategic adviser.

“Today’s funding landscape is more challenging than ever as investors and governments navigate a rapidly shifting and uncertain political and market climate,” Twinney said.