The BNP Paribas Solar Impulse Venture Fund (BNPP SIVF) has surpassed its target size, closing at €172 million. Managed by BNP Paribas Asset Management’s (BNPP AM) Private Assets division, the fund aims to support approximately 15 high-growth startups across Europe and North America focused on ecological innovation.

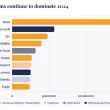

The fund, created in partnership with Bertrand Piccard’s Solar Impulse Foundation, targets key sectors including energy transition, sustainable agriculture, circular economy, biodiversity, smart cities, sustainable mobility, and industrial innovation. Recognised as an SFDR Article 9 fund and Tibi-labelled, it addresses critical ecological challenges through transformative technologies.

The BNP Paribas Solar Impulse Venture Fund (BNPP SIVF) has already invested in five innovative startups, reflecting a diverse and impactful portfolio. Among them is NatureMetrics, a UK-based company specialising in biodiversity monitoring through environmental DNA technology, enabling precise measurement and tracking of ecosystems. French scale-up Phenix focuses on circular economy solutions by reducing food and non-food waste, while Axioma, another French startup, develops bio-solutions to address agricultural challenges such as plant hydric stress. Hello Watt, also from France, offers an energy renovation platform designed to simplify and streamline home improvements for homeowners. Meanwhile, US-based Chemix is revolutionising next-generation battery design with its AI-powered self-driving lab. Additional investments are anticipated to further expand the fund’s portfolio, with a focus on high-impact climate tech solutions that drive the ecological transition.

The fund attracted a broad group of investors, including ADP Group, AGPM, BNP Paribas Cardif, Sogecap, individuals, and family offices. BNP Paribas itself committed €86 million to align with the Solar Impulse Foundation’s goals.

Bertrand Piccard, founder of the Solar Impulse Foundation, emphasised the importance of private capital in advancing sustainable innovation and said, “This fund proves that transformative solutions with tangible environmental impact can attract substantial investment, paving the way for a sustainable future.”

With a focus on startups driving the ecological transition, the BNP Paribas Solar Impulse Venture Fund is poised to play a pivotal role in advancing sustainability. Its investments highlight the growing momentum in climate-focused ventures, offering a pathway to a greener, more innovative future.