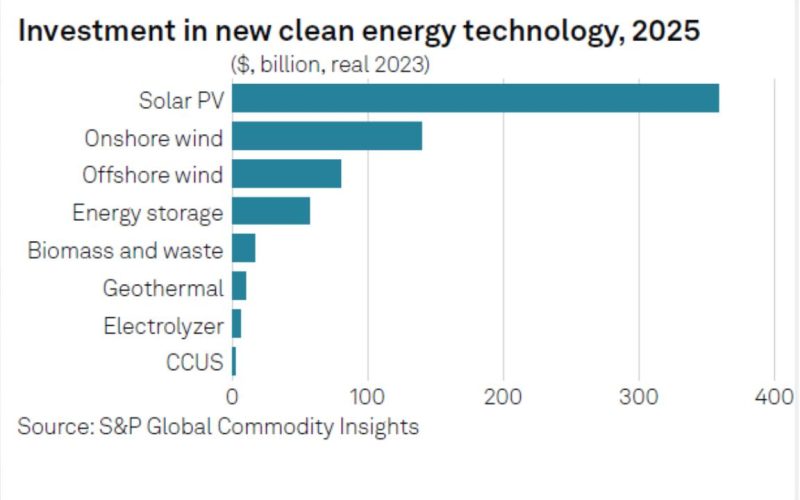

Clean energy investments are projected to reach $670 billion in 2025, overtaking upstream oil and gas spending for the first time according to S&P Global Commodity Insights. This milestone highlights a major shift in global energy priorities, with solar PV expected to dominate, accounting for half of all cleantech spending and two-thirds of installed capacity. Despite this progress, the report warns that current investment levels are insufficient to meet critical climate targets, such as tripling renewable energy capacity by 2030.

The ‘Top Cleantech Trends for 2025’ report highlights that in 2025 global spending on cleantech energy supply, including renewable power generation, green hydrogen, and carbon capture, is expected to reach $670 billion. While this marks a significant turning point, regional disparities in capital efficiency remain. China, for instance, is projected to add nearly double the gigawatts per dollar spent compared to the United States.

Edurne Zoco, Executive Director of Clean Energy Technology at S&P Global Commodity Insights, highlighted that increased cleantech energy supply investments are expected to surpass upstream oil and gas spending for the first time.

According to Eduard Sala de Vedruna, Head of Research for Energy Transition, Sustainability & Services at S&P Global Commodity Insights, 2025 is set to be a transformative year for the clean energy sector. He noted that the year will bring significant shifts in how energy is produced and consumed, driven by advancements in corporate clean energy procurement and the growing use of AI in energy management.

Oversupply of equipment in the solar, wind, and battery sectors, particularly from China, continues to reshape global supply chains, the report highlights. While price declines may stabilise in 2025, competition from Chinese manufacturers is likely to keep costs low. Projections suggest China’s share of PV module and battery cell production will drop to 65% and 61%, respectively, by 2030.

Battery energy storage is emerging as a critical component of renewable energy projects, helping to manage price fluctuations in regions with high renewable energy penetration. Challenges such as “cannibalisation,” where excessive midday energy production lowers electricity prices, highlight the need for integrated storage solutions to ensure financial viability.

The report also points out that artificial intelligence (AI) is increasingly playing a key role in renewable energy forecasting, grid management, and trading applications. By improving the accuracy of energy generation predictions, AI helps mitigate risks associated with discrepancies between forecasted and actual production. However, the rise of AI also brings challenges, such as cybersecurity risks and the need for ethical oversight.

Datacentres are expected to play a significant role in corporate clean energy procurement, sourcing approximately 300 TWh of clean power annually by 2030, up from 200 TWh today. North America is anticipated to account for 60% of this increase, reflecting the sector’s push for deeper decarbonisation.

Ammonia-based hydrogen production and carbon capture utilisation and storage (CCUS) projects are poised to make significant strides in 2025. The CCUS sector is forecast to secure 70 million metric tonnes of annual CO2 capture capacity, supported by growing corporate interest and enhanced government policies. Despite high costs, engineered carbon removal technologies are gaining traction, with increased adoption seen over the past three years.

As clean energy investments surpass oil and gas spending, 2025 is shaping up to be a transformative year for the energy transition. While advancements in technology, AI integration, and corporate sustainability efforts drive progress, the report highlights the ongoing need for increased funding and innovation to meet global climate goals.