Corporate climate action may appear to be losing steam, with fewer companies fully reporting their greenhouse gas emissions. Just 7% disclose across Scopes 1, 2 and 3, according to a new study by Boston Consulting Group (BCG) and CO₂ AI — down from 9% in 2024 and 10% in 2023. The proportion of companies setting targets to cut emissions across all scopes also fell, slipping three percentage points year-on-year from a peak of 19% in 2023. Meanwhile, only 12% of firms are assessing both physical and transition climate risks.

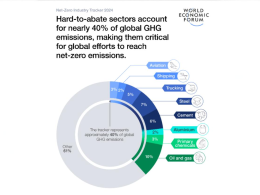

The findings come from the fifth edition of the annual report How Companies Are Tackling the Climate Challenge — and Creating Value, based on responses from 1,924 executives across 16 industries in 26 countries. Together, these companies account for around 40% of global greenhouse gas emissions.

Despite faltering disclosure, the report indicates momentum is building in other areas. Over the next five years, companies expect to increase climate-related investment, allocating an additional 16% of capital expenditure to mitigation, adaptation and resilience. On average, this equates to an extra US$69 million per company, directed towards measures such as weather-proofing assets and developing sustainable product lines.

“About 70% of companies are maintaining, if not increasing, their investments in sustainability,” said Hubertus Meinecke, BCG’s global leader for Climate & Sustainability. “This is encouraging as it shows that climate action hasn’t stalled, and momentum continues steadily around the world.”

The report highlights that climate returns are beginning to materialise. Some 82% of companies said they had already captured economic benefits from decarbonisation, largely through efficiency savings and sustainable products. Six per cent reported financial gains worth more than 10% of annual revenue — a net value of around US$221 million per company. Firms assessing both physical and transition risks estimated average financial exposure of US$790 million by 2030, yet nearly half said their adaptation efforts were already generating returns above 10%.

“What matters most is that investment and action are accelerating,” said Diana Dimitrova, managing director and partner at BCG X. “Our survey shows that companies are investing in climate action where there is a business case around strategic risk management and compelling financial returns.”

The study also notes that companies are strengthening governance and tools to embed climate into strategy. One-third now use internal carbon pricing, while adoption of climate transition plans has risen to 61%, most of them approved at board level.

According to the report, leading companies — those achieving the strongest financial returns from climate action — share four traits: comprehensive emissions and risk measurement, use of internal carbon pricing and risk modelling, adoption of transition and adaptation plans, and reliance on advanced digital solutions.

Charlotte Degot, CEO of CO₂ AI, said digital tools were a decisive differentiator: “The companies that are really getting value from sustainability are the ones leaning into AI and advanced digital tools. When companies layer multiple advanced solutions, they’re more than twice as likely to achieve real, significant benefits.”