The 2024 Nasdaq Global Net Zero Pulse survey reveals significant shifts in the voluntary carbon market (VCM) and the role of carbon credits in corporate net-zero strategies. Drawing insights from corporate carbon credit buyers, the report highlights how preferences and market dynamics have evolved over the past year, aiming to bridge knowledge gaps and support stakeholders with actionable intelligence.

Durable carbon dioxide removal (CDR) remains critical to achieving net zero goals. The survey shows 57% of respondents plan to invest in both nature-based and technology-driven carbon removal solutions to neutralise residual emissions. Notably, fewer than 10% believe they can achieve net zero without relying on carbon credits.

A striking 93% of respondents report having a formal carbon credit strategy aligned with their sustainability goals. Larger companies favour carbon removal credits, while smaller firms are inclined toward reduction or avoidance credits.

Amid scrutiny over greenwashing, corporate buyers prioritize metrics such as monitoring, reporting, and verification (MRV), cost, and permanence when purchasing carbon removal credits. These factors align with findings from last year’s survey.

Regulatory developments, including the SEC’s Climate Disclosure Rules and California’s AB-1305, are shaping corporate carbon credit strategies. A notable 72% of respondents report feeling the impact of these policies.

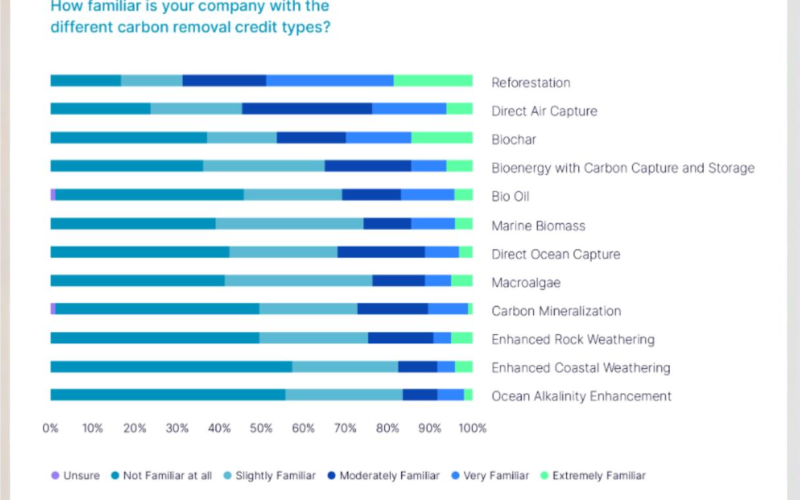

While familiarity with reforestation (83%), direct air capture (76%), and biochar (63%) is relatively high, awareness of ocean-based CDR remains low, underscoring the need for further education in specific pathways.

Despite uncertainties in demand, durable CDR solutions are gaining traction, and corporations increasingly view carbon credits as essential to their net-zero strategies. The Nasdaq ESG Advisory team emphasises the importance of aligning procurement strategies with evolving market dynamics and regulatory frameworks to ensure impactful and credible carbon credit use.