BlackRock has lost another major European pension mandate after a Dutch investor withdrew around €5 billion ($5.8 billion), citing concerns over climate action and the asset manager’s voting record, highlighting growing tensions between European and US approaches to sustainable investing.

PME, which manages €59 billion in retirement assets for workers in the metal and technology sectors, said it had decided to end its relationship with BlackRock following a review lasting several months. The decision comes shortly after a similar move by another large Dutch pension fund and reflects increasing scrutiny by European asset owners of how external managers align with their sustainability objectives.

PME said that while BlackRock had delivered strong services over many years, the pension group was reassessing which managers best matched its long-term vision and principles. As part of a revised investment strategy, PME plans to reduce the number of asset managers used for its equity portfolios from three to two, a move it said would also slightly lower costs.

BlackRock said it was grateful for the opportunity to have worked with PME and noted that it continues to manage more than €350 billion for Dutch clients overall.

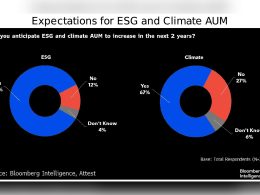

The withdrawal underscores a broader divergence between Europe and the United States on environmental, social and governance (ESG) investing. In recent years, several large US asset managers have scaled back their public emphasis on ESG amid political and legal pressure at home, including lawsuits and fund withdrawals by Republican-led pension funds accusing them of pursuing politically motivated agendas. Asset managers have rejected those claims.

That retreat has prompted some European pension funds to look for managers they believe have maintained a stronger focus on sustainability and climate risk. In September, Dutch healthcare workers’ pension fund PFZW, which manages €255 billion, pulled about €14 billion from BlackRock as part of a shift towards a more sustainability-focused investment strategy, although BlackRock continues to manage some assets for the fund. Earlier this year, the UK-based People’s Pension withdrew £28 billion from State Street, citing a renewed emphasis on sustainability and active stewardship.

Pressure has also emerged in the United States. In November, New York City’s outgoing comptroller recommended that the city’s pension funds drop BlackRock as a manager of more than $42 billion, arguing that the firm had not addressed climate risk with sufficient urgency.

A report published this year by responsible investment group ShareAction found that large US asset managers, including BlackRock, supported a small proportion of ESG-related shareholder resolutions in 2024, a sharp decline compared with levels seen earlier in the decade.

PME representatives have previously indicated that withdrawals from US asset managers could mark the early stages of a wider shift, as asset owners become more critical of managers perceived to be distancing themselves from ESG commitments.