The European Securities and Markets Authority (ESMA), the EU’s regulatory body for financial markets, has released translations of its Guidelines on the use of ESG or sustainability-related terms in fund names into all official EU languages.

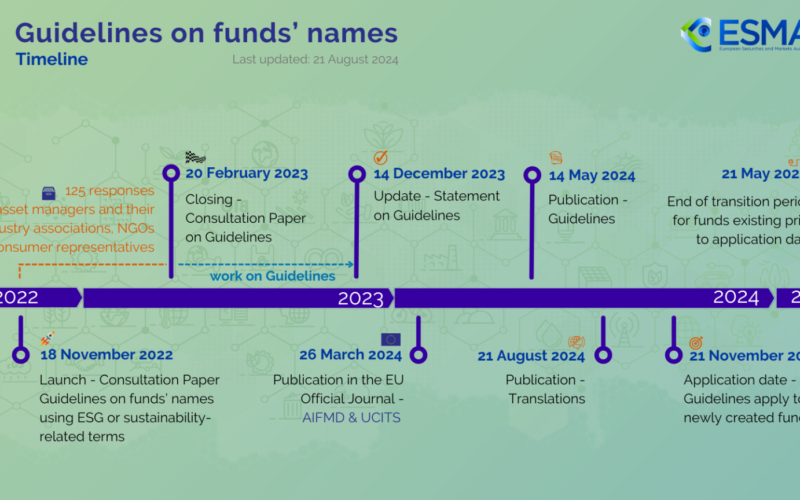

These Guidelines will take effect three months after publication, on 21 November 2024.

By 21 October 2024, national competent authorities must inform ESMA whether they (i) comply, (ii) do not comply but plan to comply, or (iii) do not comply and do not intend to comply with the Guidelines.

Existing funds will have a transitional period of six months from the application date, until 21 May 2025, to align with the Guidelines. New funds established on or after the application date must adhere to these Guidelines immediately.

The aim of the Guidelines is to protect investors from misleading or exaggerated sustainability claims in fund names and to provide asset managers with clear, measurable criteria for using ESG or sustainability-related terms in fund names.

The Guidelines stipulate that to use terms related to environmental, social, or sustainable investment objectives, at least 80% of a fund’s investments must align with these goals. They also define exclusion criteria for various terms in fund names.

Terms related to “Environmental”, “Impact”, and “Sustainability” must comply with the rules for Paris-aligned Benchmarks (PAB).

Terms related to “Transition”, “Social”, and “Governance” must comply with the rules for Climate Transition Benchmarks (CTB).

For funds using a combination of these terms or designating an index as a reference benchmark, the Guidelines specify additional criteria.

The Final Report also includes a summary of responses to ESMA’s consultation paper and explains how the feedback was addressed.