The European Supervisory Authorities (EBA, EIOPA, and ESMA) and the European Central Bank (ECB) have released the results of the “Fit-for-55” climate scenario analysis. This comprehensive study examined the potential impact of climate transition risks on the EU’s financial system, particularly when paired with macroeconomic shocks. The findings indicate that transition risks alone are unlikely to destabilise financial systems. However, when combined with broader economic stressors, they could significantly amplify financial losses, highlighting the need for coordinated policies and robust integration of climate risks into financial institutions’ strategies.

The analysis, commissioned by the European Commission, assessed the effects of implementing the Fit-for-55 package on the EU banking, investment funds, occupational pension funds, and insurance sectors. This package, a cornerstone of the EU’s climate ambitions, seeks to cut emissions by 55% by 2030 and achieve climate neutrality by 2050. It includes measures such as the EU emissions trading system, carbon border adjustment mechanism, sectoral emissions targets, and updates to renewable energy and energy efficiency directives.

To evaluate these impacts, the stress test modelled three scenarios developed by the European Systemic Risk Board (ESRB) with ECB support. The baseline scenario considered a smooth implementation of the Fit-for-55 package alongside June 2023 economic forecasts. The first adverse scenario introduced “Run-on-Brown” shocks, where investors divest from carbon-intensive firms, hindering their ability to finance greener operations. The second adverse scenario combined these transition risks with additional macroeconomic pressures, intensifying the financial strain.

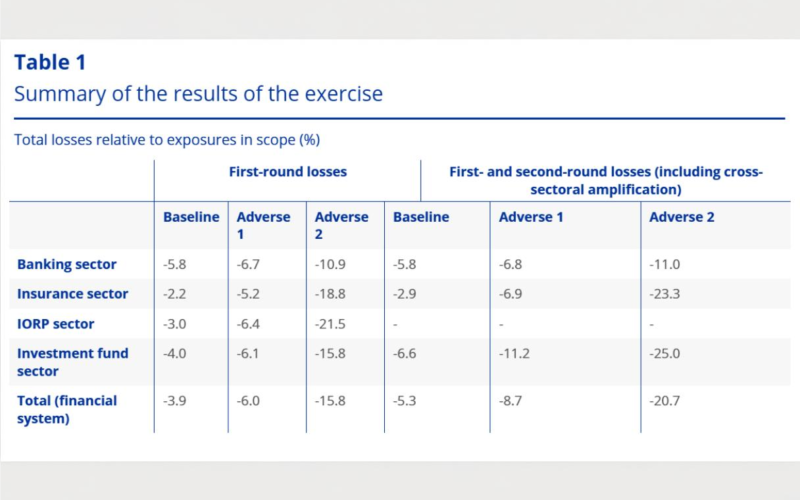

Results from the analysis showed that first-round losses under the “Run-on-Brown” scenario were limited, ranging from 5.2% to 6.7% of starting exposures across sectors, with investment funds experiencing the largest impact. Second-round losses, mostly affecting investment funds, amounted to 11.2% of initial exposures. However, the scenario combining macroeconomic shocks with transition risks led to significantly higher losses, ranging between 10.9% and 21.5% depending on the sector. Despite these losses, factors such as banks’ income, insurers’ and pension funds’ liabilities, and cash reserves in investment funds are expected to mitigate the overall capital impact on institutions.

While the analysis underscores the resilience of the EU financial system to isolated transition risks, it also reveals vulnerabilities when compounded stressors are introduced. The findings emphasise the importance of timely and coordinated policy measures to ensure the financial system can support the green transition while remaining stable.

This exercise represents a milestone in EU institutional collaboration, harmonising methodologies and leveraging sector-specific expertise to assess climate risks comprehensively. Despite data challenges and methodological novelties introducing uncertainty into the findings, the results provide valuable insights for policymakers. The analysis offers a pathway for aligning financial system resilience with the EU’s climate goals, ensuring sustainable development while safeguarding financial stability.