European carmakers increased electric vehicle (EV) sales by 38% in the first seven months of this year, leaving all major manufacturers except Mercedes-Benz on track to comply with the EU’s 2025–27 emissions targets, according to new research from Transport & Environment (T&E).

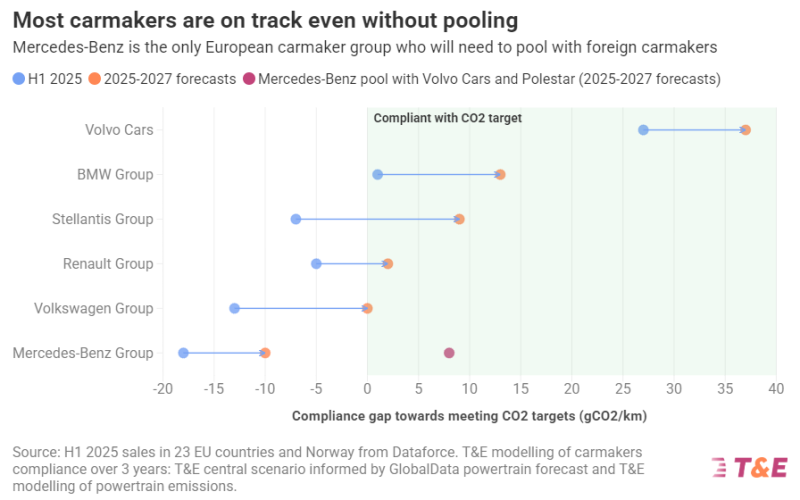

T&E’s EV Progress Report found BMW, Renault and Volkswagen are positioned to meet their obligations, with BMW forecast to be 13 grams of CO₂ per kilometre (gCO₂/km) ahead of the legal threshold, Stellantis 9 gCO₂/km, and Renault 2 gCO₂/km. Volkswagen is expected to comply with no margin to spare.

Mercedes-Benz, by contrast, is projected to miss the targets by 10 gCO₂/km and will need to purchase credits from Volvo Cars and Polestar under a pooling arrangement. The German group, which currently chairs the EU car lobby ACEA and has been among the most vocal opponents of EU climate rules, is the only manufacturer not on course to comply.

The report warns that a two-year extension granted earlier this year has eased pressure on the industry, resulting in higher EV prices and an estimated shortfall of two million electric car sales between 2025 and 2027. T&E urged the European Commission to hold firm on its 2030 and 2035 targets, ahead of a strategic dialogue on the automotive sector later this week.

Despite the regulatory concessions, market dynamics are favouring electrification. Battery costs are expected to fall 27% between 2022 and the end of this year, and by a further 28% by 2027. Charging infrastructure has also expanded, with 77% of the EU’s core highway network now covered and member states already surpassing the 2025 minimum target for public charging points.

T&E’s cars director, Lucien Mathieu, said: “OEMs are painting a terrible picture because they want their targets weakened. But the reality is that electric car sales are surging and emissions rules are key to that equation. Weakening the targets could see other manufacturers go the way of Mercedes, which is falling behind on electrification and must buy credits from its competitors.”

The debate in Europe comes as global markets accelerate their own transitions. EVs already account for 24% of sales in Thailand, 13% in Indonesia, and 30% of China’s market by 2025. T&E cautioned that unless European firms keep pace, Chinese manufacturers are likely to dominate.

“European carmakers are living in cloud cuckoo land if they think China will stop innovating while they try to prolong the technology of the past,” Mathieu added. “If the European Commission allows car manufacturers to stall on EV progress, Europe risks becoming a car museum.”