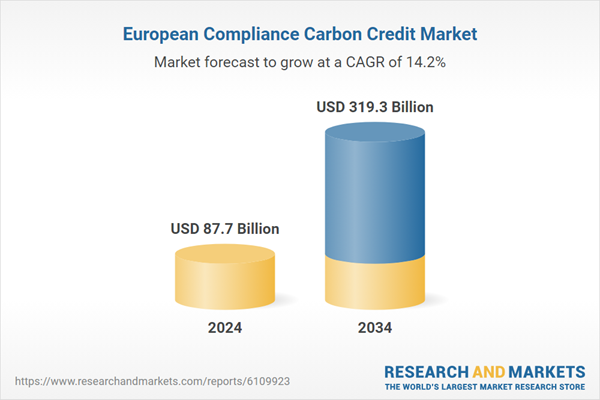

Europe’s compliance carbon credit market is projected to surge from USD 87.7 billion in 2024 to USD 319.3 billion by 2034, growing at a compound annual growth rate (CAGR) of 14.2%, according to a new report titled “Europe Compliance Carbon Credit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 – 2034”, published by ResearchAndMarkets.com.

The anticipated growth is largely driven by increasingly stringent climate policies across the continent, particularly through frameworks like the EU Emissions Trading System (ETS), which cap total greenhouse gas emissions and require companies to offset excess emissions through verifiable carbon credits. The move effectively converts carbon dioxide emissions into financial liabilities, compelling industries to reassess energy and operational strategies.

By attaching a cost to each tonne of CO₂ emitted, carbon pricing mechanisms act as both deterrents and incentives—discouraging pollution while encouraging investments in low-carbon technologies and renewable energy. This dynamic is helping accelerate Europe’s transition to cleaner business models across sectors.

Companies are also developing more rigorous carbon accounting and verification systems to meet rising regulatory and market expectations. These frameworks enhance confidence in carbon offset projects, particularly among investors and consumers increasingly favouring sustainability.

The forestry and land-use sector accounted for 22.1% of the market in 2024, driven by projects such as reforestation, afforestation, and sustainable forest management. These nature-based solutions not only sequester carbon but also support biodiversity conservation, providing high-quality removal credits that are central to corporate net-zero strategies.

Germany generated USD 8.4 billion in compliance carbon credits in 2024, underpinned by stringent emissions caps on heavy industry and growing investment in hydrogen infrastructure and carbon capture technologies. The country is positioning itself as a leader in integrated climate action.

Key market players include ALLCOT, Atmosfair, BP, Bluesource, CarbonClear, CDP, Climate Impact Partners, EcoAct, Ecosecurities, Shell, South Pole, The Carbon Trust, and TotalEnergies. These organisations are expanding their reach through digital carbon tracking platforms, standardised reporting, and strategic partnerships with governments and local communities. Many are also acquiring carbon asset developers to secure long-term credit supply.

Overall, Europe’s compliance carbon credit ecosystem is maturing rapidly, presenting new growth opportunities for companies across energy, manufacturing, and land-use sectors.