A new report by responsible investment non-profit ShareAction reveals that Europe’s 20 largest banks are falling short of their net-zero commitments, with many prioritising sustainable finance targets over meaningful decarbonisation efforts. The report, titled “Mind the Strategy Gap,” assesses banks’ strategies for emissions reduction and sustainable finance, highlighting key areas where these banks are not fully aligned with climate action goals.

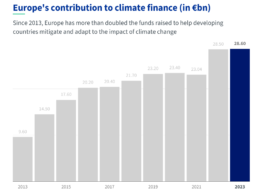

ShareAction’s findings show that decarboniaation efforts across these banks remain limited in scope, while sustainable finance targets often lack strong, transparent methodologies, making it difficult to assess their actual impact. Notably, 18 of the 20 banks, including HSBC, Barclays, and BNP Paribas, are unlikely to meet the International Energy Agency’s (IEA) recommended $10-to-$1 green investment-to-fossil-fuel financing ratio by 2030. Only NatWest and Nordea appear to be on track to meet this target.

The report also identifies inconsistencies in how banks handle capital markets facilitation within their climate strategies. Although 17 of the banks incorporate capital markets facilitation into their sustainable finance goals, only two – Barclays and HSBC – apply the same approach to their decarbonisation targets. This discrepancy, according to ShareAction, creates a skewed perspective where climate risks are downplayed while climate-related opportunities are amplified, despite financial activities like bond issuance having significant long-term environmental impacts.

Additionally, the report notes that none of the banks explicitly link their decarbonisation reporting with their sustainable finance targets, which ShareAction views as a missed opportunity for transparency and accountability.

Xavier Lerin, ShareAction’s senior research manager said, “Europe’s biggest banks have a vital role to play in financing the transition to a low-carbon economy, such as scaling up renewable energy, making real estate energy efficient and supporting important industries to decarbonise.”

He added, “However, our analysis shows that in the majority of cases, the climate targets banks are using as a roadmap to transition are not fit for purpose, which is putting at risk our ability to protect society from the worst impacts of climate change.”

Further analysis reveals that even the most ambitious green finance targets remain relatively small in comparison to the banks’ overall assets. HSBC’s goal of $1 trillion in sustainable investment by 2030, for instance, constitutes only 1.8% of its total assets, while Barclays’ target represents just 3.2%. The report also highlights that inconsistent accounting practices lead banks to overstate sustainable finance achievements, with 63% of decarbonisation targets accounting only for loans already paid out, while 76% of sustainable finance targets include both paid-out and undrawn loan amounts. This practice creates an imbalance between decarbonisation efforts and sustainable finance claims.

The report also highlights disclosure challenges, as stakeholders struggle to assess the impact of banks’ climate targets due to insufficient transparency on how these targets are met. Although some banks implement effective decarbonisation strategies, others employ accounting methods that reduce emissions only on paper. Only ING provides a detailed breakdown of the factors influencing its financed emissions, and just a quarter of banks differentiate between financing methods, complicating stakeholder assessments of banks’ governance on sustainable finance.

Another critical gap is the lack of clear criteria for transition plans required for companies to access sustainable financing. While most banks have set sector-specific decarbonisation targets, only nine have equivalent plans for sustainable finance.

ShareAction is calling on banks to establish more ambitious and science-based climate targets and is engaging with bank CEOs to align their goals with true climate action. Lerin said, “We urgently need banks to set more ambitious and coherent targets that transparently map out how they will live up to their commitment to finance the renewable power, green infrastructure and technologies needed to protect people and our economies.”