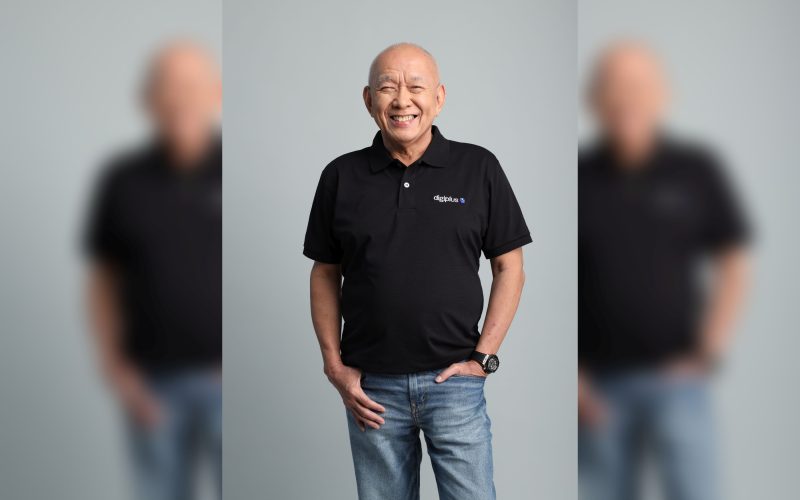

As a media partner for the Asia Integrated Reporting Awards (AIRA) 2024, ESG Post had the opportunity to speak with Mr. Eusebio H. Tanco, Chairman of DigiPlus Interactive Corp., to explore the company’s journey in adopting integrated reporting and the significance of winning Gold for Asia’s Best Integrated Report (first time).

In this exclusive interview, Mr. Tanco shares insights on the challenges and rewards of integrating financial and non-financial information, the evolving role of ESG factors in business strategy, and what the future holds for integrated reporting in Asia. He also provides valuable advice for organisations aspiring to achieve excellence in corporate reporting.

Tell us why you have adopted integrated reporting for your company.

Integrated reporting provides a holistic view of how DigiPlus creates value, integrating financial performance with the broader environmental, social, and governance metrics. It helps us articulate how our performance, strategy, and sustainability efforts drive long-term success. Adopting the Integrated Reporting (IR) Framework also reinforces our commitment to transparency, responsible business growth, and global best practices, ensuring that our stakeholders have a clear understanding of our performance and strategic direction.

What were the key challenges you encountered while integrating financial and non-financial information into a single, coherent report, and how did your team overcome them?

A key challenge was balancing key priorities within the organisation. To bridge these priorities, we conducted a comprehensive materiality assessment, directly engaging stakeholders to identify what matters most to them. This helped us create a cohesive and insightful report that connects financial performance with sustainability, while demonstrating how ESG factors contribute to long-term business resilience.

What steps do you take to make your integrated report reliable and credible?

Trust and credibility are built on standards and transparency. DigiPlus’ reporting adheres to globally recognised frameworks such as the International Integrated Reporting Council (IIRC), Global Reporting Initiative (GRI), and Sustainability Accounting Standards Board (SASB). We also prioritise clarity and accessibility, ensuring that our stakeholders can easily interpret our disclosures. Our goal is to make reporting not just compliant, but truly meaningful.

How has the adoption of integrated reporting influenced your internal decision-making and strategic planning processes?

Integrated reporting has embedded a deeper sustainability mindset within DigiPlus, shaping how we assess risks, opportunities, and longer-term strategy. It has reinforced internal dialogues on ESG, leading to a greater focus on responsible gaming, ethical business practices, and stakeholder trust. By viewing financial and non-financial performance as interconnected, we are making more informed and calculated decisions that align with our commitment to sustainable growth.

With evolving stakeholder expectations and regulatory landscapes, how do you see the future of integrated reporting in Asia, and what initiatives are you planning to stay ahead of these trends?

Asia’s regulatory landscape is evolving fast, with sustainability reporting becoming a standard expectation rather than an option. With increasing emphasis on material ESG issues – such as climate resilience and responsible business practices – companies must be proactive, not reactive. DigiPlus is committed to staying ahead by continuously aligning with emerging global frameworks and integrating sustainability deeper into our business strategy. For us, integrated reporting is not only about compliance, but also about demonstrating leadership in responsible corporate governance.

What do you think would be the future of integrated reporting in the next five years?

In five years, integrated reporting will no longer be a differentiator but a baseline expectation for any company that wants to be seen as credible, forward-thinking, and responsible. We anticipate greater harmonisation between financial and non-financial reporting standards, driven by regulatory shifts and investor demand for more transparent, data-driven ESG disclosures. Companies that embrace this shift can gain stakeholder trust, which is a competitive advantage.

What advice would you offer other organisations aspiring to reach similar levels of reporting excellence as recognised by AIRA?

Start with purpose, not just compliance. The best reports don’t just meet standards – they tell a compelling, authentic story about a company’s impact and vision. Engage stakeholders early to understand their priorities, and commit to continuous improvement in transparency and accountability. Integrated reporting isn’t just about what you disclose, but also about how you create and communicate value in a way that resonates, builds trust, and drives sustainable growth.