As a media partner of the Asia Integrated Reporting Awards (AIRA) 2024, ESG Post had the opportunity to interview Mr. Malindu Ranasinghe, Director and CEO of Oxford College of Business (OCB), Sri Lanka, one of this year’s standout winners. OCB clinched Gold in Asia’s Best Integrated Report (SME) category, a remarkable achievement highlighting the institution’s commitment to transparency, sustainability, and holistic value creation through integrated reporting. In this exclusive interview, Mr. Ranasinghe shares the journey behind adopting integrated reporting despite being an unlisted SME, the challenges his team overcame, and how this strategic shift has reshaped their internal processes and long-term vision.

Why did you adopt integrated reporting for your company?

At Oxford College of Business (OCB), the decision to adopt integrated reporting was driven by our deep commitment to transparency, accountability, and sustainability. While we are not a listed company and there are no regulatory requirements compelling us to adopt such practices, we took a proactive step in recognising the long-term value that integrated reporting could bring. We firmly believe that in today’s world, it is no longer enough to focus solely on financial performance. Stakeholders—including students, alumni, faculty, and industry partners—demand a more comprehensive view of an organisation’s overall impact.

By embracing integrated reporting, we have been able to demonstrate how our financial and non-financial strategies align with our core values and objectives. This holistic approach not only helps us maintain a strong relationship with our stakeholders but also sets a benchmark for organisations in Asia. Furthermore, this process has allowed us to enhance our decision-making processes, ensuring that we are steering the organisation in the right direction, aligned with both current trends and future needs in education and business.

What challenges did you encounter when integrating financial and non-financial information, and how did your team overcome them?

Integrating financial and non-financial information was a profound challenge, primarily because these areas had historically been seen as separate silos within the organisation. The most significant difficulty we encountered was aligning our sustainability strategy with our business strategy in a way that felt organic and authentic. It required us to look beyond the traditional confines of financial reporting and recognise that non-financial metrics—such as educational impact, student outcomes, and community contributions—were equally critical in demonstrating our performance.

Unlike listed companies, which are typically governed by a mandatory set of codes of best practices, organisations like ours—non-listed institutions and SMEs—lack such regulatory frameworks. This absence of standardised reporting codes often leaves companies without a clear guide, making it significantly harder to ensure that both financial and non-financial performance are integrated in a way that satisfies both internal and external stakeholders.

This lack of regulatory structure for SMEs posed a unique challenge, as we needed to create our own frameworks for transparency and accountability. We had to define and standardise our own processes, particularly in the realm of sustainability reporting. This process wasn’t just about collecting data; it was about aligning our values and ensuring that the information we provided resonated with our strategic objectives and addressed the interests of our stakeholders, who expect a holistic view of performance.

Moreover, creating a narrative that seamlessly blended these elements in a way that was intelligible, insightful, and compelling was no small feat. The process was iterative getting it right took time, testing, and refining. Initially, there was a natural hesitation as we ventured into unfamiliar territory, but we turned this challenge into an opportunity. By involving cross-functional teams, ranging from finance to sustainability experts and faculty members, we built a collaborative environment that helped shape the process. We also relied on external advisors and best practices from international frameworks like the Global Reporting Initiative (GRI) and International Integrated Reporting Council (IIRC) to guide our journey.

As we learned from these experiences, the key to overcoming these challenges was adopting a mindset of continuous improvement—we understood that perfect alignment may take time, but it was through persistence, feedback loops, and strategic patience that we could eventually integrate these elements into a coherent and effective report.

What steps do you take to make your integrated report reliable and credible?

The credibility and reliability of our integrated report are paramount to us. We do not take these aspects lightly, and to ensure that our reports meet the highest standards, we follow a rigorous process. Our financial reports are audited by RTA Chartered Accountants, one of Sri Lanka’s leading audit firms, whose impartial assessment ensures the accuracy and completeness of our financial data.

However, integrated reporting goes beyond just financial audits. We also place significant emphasis on non-financial reporting, which is equally critical to our transparency. This part of the report is assured independently through an external assurance report, validating the accuracy of our non-financial metrics and ensuring they reflect our actual performance. This combination of financial auditing and independent assurance establishes a strong foundation for stakeholder trust.

In addition to this, we ensure that our integrated report aligns with internationally recognised standards and frameworks, such as the International Integrated Reporting Framework and Global Reporting Initiative (GRI), to further enhance its reliability and credibility. By doing so, we not only meet regulatory requirements but also go beyond, showcasing our commitment to global best practices in integrated reporting.

How has the adoption of integrated reporting influenced your internal decision-making and strategic planning processes?

The adoption of integrated reporting has been a game-changer in how we approach decision-making and strategic planning. Prior to integrating financial and non-financial reporting, we primarily relied on financial performance as the key indicator of success. However, now we are equipped to make decisions that are informed not just by profits, but by a holistic view of performance that incorporates sustainability, governance, and social impact.

This shift has allowed us to align our business objectives with our ethical responsibilities more effectively. It has provided our leadership team with the tools to not only track financial performance but also to evaluate how our activities and initiatives contribute to the wider community and environment. Through performance metrics related to student success, social impact, and sustainability, we have created a more balanced and inclusive approach to our long-term strategy.

Furthermore, integrated reporting has strengthened our internal accountability. It provides us with the means to measure and track progress on initiatives related to sustainability and governance, ensuring that we are consistently moving towards our vision of becoming an institution that creates not just educational value, but social value.

What do you think the future holds for integrated reporting in Asia, and how do you plan to stay ahead of these trends?

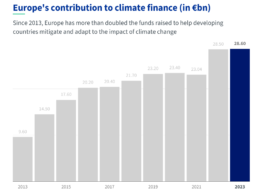

In the next few years, I strongly believe that integrated reporting will evolve further, becoming a core element of corporate governance and decision-making. I envision that, in Asia, we will see more and more organisations adopting this holistic approach as stakeholders increasingly demand transparency not only about financial results but also about social impact, sustainability, and governance.

I foresee that integrated reporting will eventually become the norm for businesses across the region, particularly as consumers and investors alike become more discerning about how organisations are aligning their strategies with global sustainability goals and ethical governance. For Oxford College of Business, we are committed to staying ahead of these trends by innovating continuously and integrating new technologies and practices that will enable us to present our reports in even more dynamic and engaging ways.

We are already exploring ways to integrate sustainability reporting even further into our annual reports, reducing duplication and streamlining the reporting process. Our goal is to lead the conversation on responsible reporting in Sri Lanka and Asia.

What is your vision for integrated reporting over the next five years?

In the next five years, I see integrated reporting becoming the standard rather than the exception, particularly for small and medium-sized enterprises (SMEs). As consumers and stakeholders increasingly demand transparency in the organisations they engage with, businesses will need to adopt more robust reporting frameworks to demonstrate their corporate responsibility. This shift will be driven not just by regulation, but by the growing public awareness of environmental and social issues.

We also expect that technological advancements will play a crucial role in the future of integrated reporting, enabling organisations to collect and present data more efficiently, accurately, and dynamically. Artificial intelligence (AI) and big data will likely reshape how organisations approach sustainability reporting, making it more precise and integrated into the company’s overall strategy.

What advice would you offer to other organisations aspiring to achieve excellence in integrated reporting and receive the same level of recognition?

My advice to any organisation looking to achieve excellence in integrated reporting is simple yet profound: focus on governance and sustainability, and the profits will follow. In today’s business environment, stakeholders are increasingly prioritising ethical practices, sustainability, and transparency. These values should be embedded in every level of the organisation, from senior management to the front line.

Integrated reporting should not merely be seen as a compliance exercise—it is an opportunity to showcase how your organisation is creating value beyond financial metrics. A focus on strong governance and sustainability will not only enhance your reputation but will also build trust with stakeholders, thereby fostering long-term success.