Climate change poses significant material risks to companies, supply chains, and financial markets as shifting weather patterns and extreme events disrupt operations and drive up costs. A new report by CDP, supported by HSBC, emphasises the urgency for companies to build resilient, net-zero, and nature-positive supply chains to mitigate these risks.

With supply chain emissions (scope 3) averaging 26 times greater than direct operational emissions (scopes 1 and 2), transparency and climate action across the supply chain are critical.

CDP’s analysis of over 23,000 companies’ 2023 disclosures reveals that failure to address climate-related risks in supply chains can be nearly three times costlier than taking preventative measures.

Moreover, disclosing companies estimate that upstream climate-related opportunities could result in $165 billion in potential financial gains. Companies that invest in these initiatives stand to gain.

Despite this, only 1 in 4 companies are integrating supply chain climate risks into their risk management, with only 15% actively targeting emissions across their value chains.

The report also shows that through CDP’s Supply Chain Programme, members are demonstrating that engagement and collaboration lead to action. Suppliers disclosing through CDP reported that engagement from buyers led to 43 million tonnes in emissions reductions, more than the total annual emissions of Sweden.

Additionally, banks can play a vital role by offering preferential financing tied to environmental criteria, boosting emissions reductions. Suppliers offered financial incentives were 52% more likely to cut emissions compared to those receiving only training.

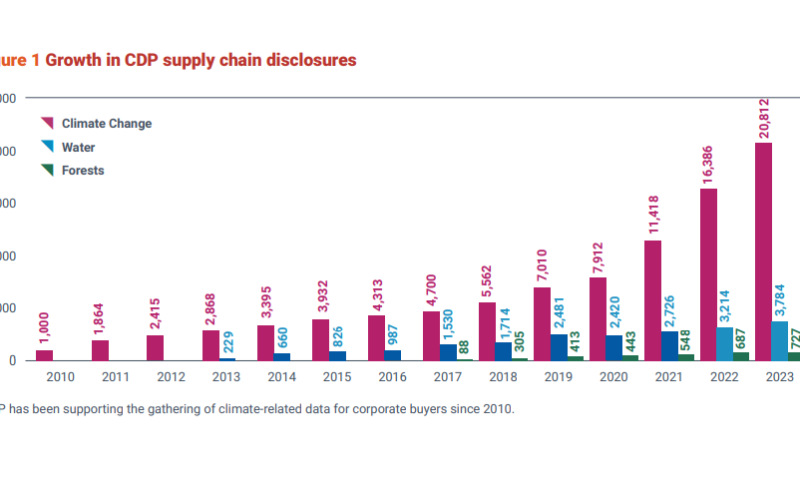

The report also identifies buyer practices that are effective at driving climate action from suppliers, based on insights from more than 340 major corporate buyers engaging their suppliers through CDP’s Supply Chain Programme. It highlights the critical need for corporations to enhance supply chain sustainability and drive meaningful climate action to future-proof their operations.