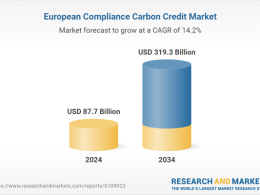

The global carbon credit validation, verification, and certification market is projected to see significant growth, with revenue expected to rise from $226 million in 2024 to $884 million by 2030, at a CAGR of 25.5%, according to a new report by MarketsandMarkets.

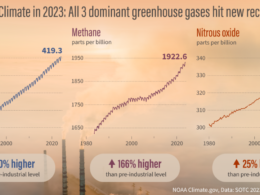

This market expansion is propelled by several critical factors including government regulations, sustainability initiatives, technological advancement and international climate agreements. Governments worldwide are enforcing stringent regulations and carbon pricing mechanisms, such as the EU Emissions Trading System and California’s Cap-and-Trade Program, which necessitate the validation, verification, and certification of carbon credits, ensuring organizations meet their compliance obligations.

Corporate sustainability initiatives and investor emphasis on environmental, social, and governance (ESG) criteria further fuel demand for robust certification standards. Companies are voluntarily purchasing carbon credits to offset their carbon footprints, driving demand for rigorous validation and verification processes. Technological advancements, including blockchain, remote sensing and Geographic Information Systems (GIS), enhance the efficiency and accuracy of these processes, boosting market confidence. Additionally, international climate agreements like the Paris Agreement, which set ambitious global targets for reducing greenhouse gas emissions, encourage countries to adopt carbon pricing mechanisms and promote the use of carbon credits.

The report highlights that the Agriculture & Forestry sector is expected to hold the second-largest market share in the carbon credit validation, verification, and certification market. These sectors are pivotal due to their substantial carbon sequestration capabilities and the increasing adoption of sustainable practices. Governments and international initiatives like REDD+ incentivise these practices, corporations and investors see these sectors as crucial for offsetting carbon footprints and integrating environmental goals into their strategies, and technological advancements bolster confidence in these sectors’ contributions to the market.

North America is expected to be a major market, supported by strong regulatory frameworks and corporate sustainability efforts.

According to the study, leading companies in this market include VERRA, Gold Standard, DNV GL, and SGS Société Générale de Surveillance SA, among others, who are crucial in ensuring the integrity and credibility of carbon credits, supporting global efforts to reduce greenhouse gas emissions.