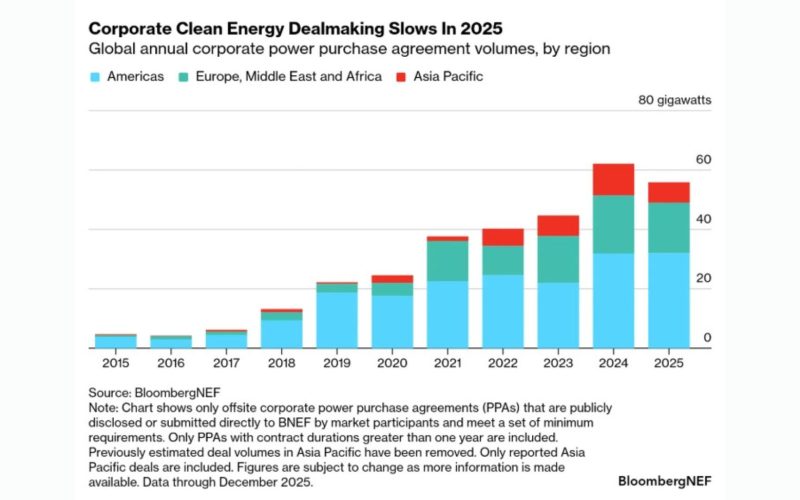

Global corporate clean power purchase agreement (PPA) volumes declined in 2025 for the first time in almost a decade, as rising power prices and policy uncertainty weighed on activity, according to BloombergNEF.

Corporates announced 55.9 gigawatts (GW) of clean power deals in 2025, down 10% from the previous year’s record, BNEF said in its 1H 2026 Corporate Energy Market Outlook.

The market is increasingly split between large technology firms and other corporate buyers. Meta, Amazon, Google and Microsoft accounted for 49% of global PPA activity in 2025. Meta and Amazon together contracted 20.4GW, including 4.7GW of nuclear capacity. Meta’s deals were largely concentrated in the US, while Amazon was the most active buyer in Europe and Asia Pacific.

The US remained the largest market, with a record 29.5GW of deals, driven by major technology firms shifting towards nuclear, hydro and geothermal projects. However, smaller corporate buyers became less active as project costs increased and policy risks intensified. The number of unique US corporate buyers fell 51% year-on-year to 33.

In Europe, the Middle East and Africa, volumes declined 13% to 17GW, with activity in Europe returning to 2023 levels. Rising periods of negative power prices reduced the value of standalone solar and wind contracts, prompting greater interest in hybrid portfolios.

Asia Pacific volumes dropped to 6.9GW from 10.7GW the previous year, reflecting slower activity in India and South Korea. BNEF said the region is diverging between more advanced PPA markets such as Japan and countries like Malaysia, where growth remains dependent on regulatory frameworks.

Nayel Brihi, BNEF corporate energy analyst and lead author of the report, said: “Corporate clean energy buyers are operating at two different speeds. Large tech buyers are venturing into bigger deals and frontier technologies, while smaller companies are grappling with power market realities. Some buyers in newer markets are just familiarizing themselves with the concept of offtake agreements altogether. For the market to return to growth, we will need to see clean, firm power supply options such as co-located solar and storage delivering at scale, and at competitive prices.”

On the supply side, Engie was the top developer globally, contracting 3.6GW. Seven of the top 10 sellers signed agreements involving clean, firm power solutions, including co-located solar and storage, hybrid solar and wind, and nuclear PPAs. These “baseload-like” contracts accounted for 5.2GW of activity.

Regulatory changes are also influencing procurement strategies. The Greenhouse Gas Protocol is updating its Scope 2 guidance, with proposed revisions that could require hourly emissions tracking and tighter geographical matching for indirect electricity purchases. Under such rules, 100% renewable energy claims may become more difficult to substantiate.

In response, companies are already shifting towards more complex deal structures. BNEF tracked 5.8GW of co-located and hybrid agreements in 2025, with falling battery costs expected to support further adoption of such arrangements.