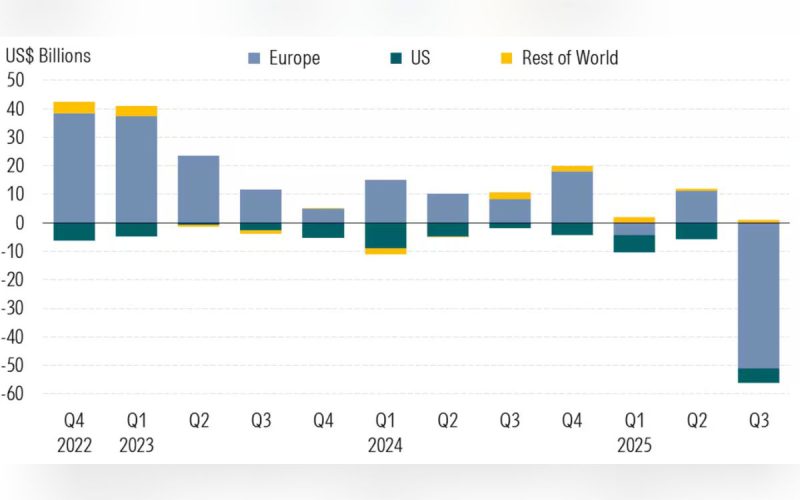

Global sustainable mutual funds and exchange-traded funds recorded net outflows of around USD 55 billion in the third quarter of 2025, according to a new report by Morningstar. The decline was driven largely by redemptions from several UK-domiciled BlackRock funds after a pension client moved assets into customised ESG mandates managed by the same firm.

Even excluding these BlackRock-related withdrawals, global sustainable funds posted net outflows of USD 7.2 billion, reversing the USD 6.2 billion in restated inflows during the previous quarter. Fixed-income strategies were the only segment to attract new capital, with global net subscriptions totalling USD 12.5 billion.

Europe sees sustained investor caution

Morningstar’s analysis shows that, once the BlackRock outflows are excluded, European sustainable funds saw USD 3.1 billion in net redemptions during the quarter. Passive strategies drove most of the withdrawals, while active sustainable funds attracted USD 6.0 billion in inflows.

The report cites geopolitical uncertainty, shifting economic priorities and regulatory ambiguity — including the Omnibus Package and the ongoing review of the EU Sustainable Finance Disclosure Regulation — as factors dampening investor appetite. Concerns over performance have also weighed on sentiment.

However, renewable energy stocks have bucked the trend. Boosted by surging electricity demand from data centres supporting artificial intelligence, the Morningstar Global Renewable Energy Index delivered a year-to-date gain of 21% at the end of September, outperforming broader market indices.

US funds see twelfth consecutive quarter of outflows

In the United States, sustainable funds reported net outflows for the twelfth quarter in a row, though withdrawals moderated to USD 5.1 billion, compared with USD 5.9 billion the previous quarter. Morningstar attributes the prolonged redemptions partly to the intensifying anti-ESG backlash under the Trump administration. Despite this, market performance pushed total US sustainable fund assets to USD 367 billion — matching their 2021 peak.

Growth outside major markets

Sustainable funds elsewhere in the world attracted more than USD 1 billion in new money in the third quarter. Overall, global sustainable fund assets edged up by roughly 4% to USD 3.7 trillion as of September 2025, supported by rising equity and bond markets.

Europe accounts for 85% of total global sustainable fund assets, followed by the US at 10%, with the remainder distributed across other regions. Sustainable strategies represent about 19% of Europe’s open-end fund and ETF universe, compared with just 1% in the US.

Fund renaming slows after ESMA rule changes

The report also highlights a slowdown in fund renaming activity after a surge earlier this year prompted by the EU’s ESMA fund-naming guidelines. Morningstar identified 118 renamed funds in the third quarter, including 64 that removed ESG-related terms, 43 that swapped one ESG-linked label for another and 11 that added such terms.

Since the start of 2024, at least 1,500 funds — around 28% of the universe and representing USD 1.07 trillion in assets — have been renamed. Most have dropped terms such as “ESG” or “sustainable”, replacing them with alternatives including “transition”, “screened”, “select”, “committed”, “advanced” and “tilt”. These changes have appeared primarily in passive fund names, often to indicate exclusion-based ESG approaches that continue to attract specific investor groups.