Goldman Sachs Group Inc. has announced that it is more than 80% of the way toward achieving its 2030 target of deploying $750 billion to support the transition to a low-carbon economy and drive what it terms “inclusive growth.”

The Wall Street bank disclosed its progress in its annual 10-K filing on Thursday. However, in the same document, Goldman removed previously stated diversity targets, aligning with similar moves by several of its US banking peers. The bank maintains that it can advance sustainability efforts by partnering with clients, developing sustainability-linked financial solutions, offering strategic advice, and co-investing in energy firms.

The update comes as Wall Street financial institutions navigate the Trump administration’s growing opposition to diversity, equity, and inclusion (DEI) policies and net zero commitments. Goldman Sachs was the first major US bank to exit the Net-Zero Banking Alliance in December but stated at the time that it remained committed to supporting clients in their transition to a low-carbon economy.

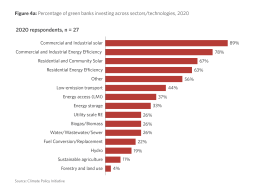

Goldman’s $750 billion sustainable finance initiative, established at the end of 2019 and set to run through the decade, encompasses financing, investment, and advisory services. This includes revenue from mergers and acquisitions, initial public offering advisory services, loans, and bonds. The funds are being directed toward businesses in clean energy, low-carbon transport, and sustainable food and agriculture.

Despite mounting political challenges in the US, climate finance continues to attract substantial capital. According to BloombergNEF, global investment in the energy transition exceeded $2 trillion for the first time in 2024, underscoring ongoing momentum in the sector.