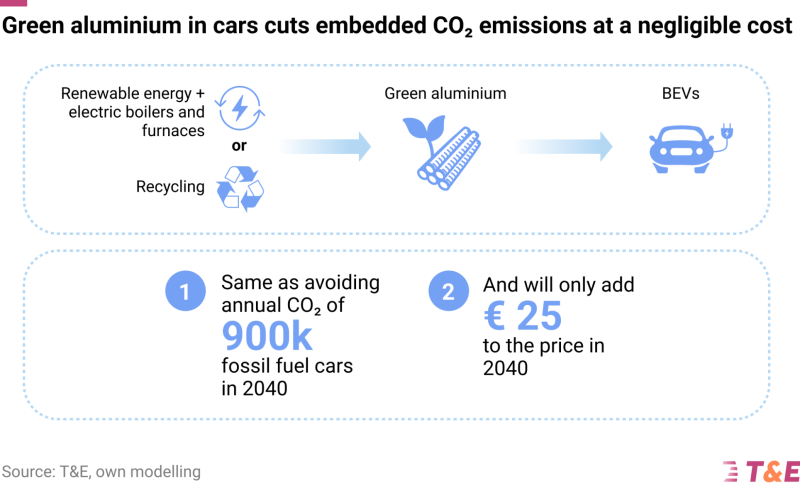

As tailpipe emissions fall with the rollout of electric vehicles, attention is increasingly turning to the climate impact of car manufacturing — which accounts for around 60% of an EV’s total footprint. New research from Transport & Environment (T&E) shows that aluminium production is a major contributor, responsible for roughly one-fifth of manufacturing emissions.

The report finds that switching to low-carbon or “green aluminium” could add as little as €25 to the cost of a new car by 2040, while significantly reducing emissions and strengthening Europe’s position in clean-technology supply chains.

Europe’s potential advantage in green aluminium

Aluminium production is highly energy-intensive: smelting one tonne requires roughly ten times the electricity an average EU household consumes in a year. Because Europe’s power grid is cleaner than many other regions, the EU has a potential competitive edge in producing low-carbon aluminium.

Green aluminium includes recycled aluminium and primary aluminium produced using electrified heating and emerging low-carbon technologies. T&E argues that wider adoption would sharply reduce emissions linked to EV production.

The automotive sector is already Europe’s largest aluminium consumer, accounting for more than one-third of demand. According to the T&E study, using green aluminium in EU car production by 2040 could reduce emissions equivalent to removing 900,000 fossil-fuel cars from the road.

The report suggests that content targets — requiring 60% green aluminium in new cars by 2035 and 85% by 2040 — are achievable and vital to scaling production. These targets, it says, would help lower costs over time, limiting the price impact to about €25 per car in 2040.

Michael Carron, battery and materials researcher at T&E, said: “Electric vehicles are far better for the planet than combustion engines. Thanks to green aluminium, that advantage is only going to grow. Europe’s comparatively clean power grid means it’s poised to lead the world in this technology, but it won’t happen without mobilising one of the biggest consumers of aluminium, the auto industry. Smart targets and local content requirements can help unleash this potential.”

Rebuilding Europe’s aluminium industry

The EU currently imports more than half of the primary aluminium it uses, a dependency expected to increase as demand rises from EVs and other clean-technology sectors. Over the past decade, the number of EU smelters has halved, raising concerns about strategic vulnerabilities.

T&E argues that requiring green aluminium to be produced in Europe would help revive the sector and support the bloc’s climate and competitiveness goals. It also calls for targets to increase the use of recycled, locally sourced aluminium and for limits on scrap aluminium exports.

Policy action expected next month

T&E has urged the European Commission to include green aluminium content requirements for carmakers in the forthcoming Industrial Accelerator Act, due next month. Under its proposal, only green aluminium produced in Europe would count towards meeting the targets.

As part of the upcoming Circular Economy Act, T&E also recommends that the Commission introduce EU-wide recycling targets — based on domestically sourced scrap — through an amendment to the End-of-Life Vehicles Regulation.