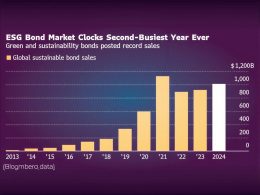

Investors have channelled record sums into climate-friendly assets this year, defying policy and regulatory rollbacks in the US and Europe, as surging demand for energy infrastructure linked to artificial intelligence underpins confidence in green markets.

Global issuance of green bonds and loans has reached a record $947 billion so far this year, according to data compiled by Bloomberg Intelligence. At the same time, equity indices tracking renewable energy are on course for their first annual gains since 2020, outperforming the S&P 500 by a wide margin, while shares of power-grid technology companies have remained in favour.

The strong flows come despite a challenging political backdrop. US President Donald Trump has backed fossil fuels and dismantled several clean-energy subsidies and regulations, while parts of Europe have rolled back environmental rules amid concerns over economic growth and competitiveness.

Investors have instead focused on clearer policy signals in parts of the market and a near-4% expected rise in global electricity demand, driven by artificial intelligence, cooling requirements and broader electrification.

“Green investments are increasingly becoming viewed as core infrastructure and industrial plays, not just niche ESG trades,” said Melissa Cheok, associate director for ESG investment research at Sustainable Fitch. “Capital is likely flowing toward areas with clear revenue visibility, policy backing and structural demand such as grid upgrades and renewables tied to electrification.”

In Asia-Pacific, companies and government-linked issuers raised $261 billion through green debt, up about 20% year on year, with China and India continuing to back renewable energy expansion, according to Bloomberg Intelligence. China recorded a record $138 billion in green bond issuance, led by its largest lenders, and launched its first sovereign green bond in London earlier this year.

Lower borrowing costs associated with so-called “greenium” pricing remain most visible in the Asia-Pacific region. Some issuers secured discounts of more than 14 basis points for green-labelled bonds in November, according to BloombergNEF. Proceeds from green bonds are typically used to finance renewable energy projects or lower-carbon transport.

BNP Paribas and Credit Agricole have been the leading underwriters of green bonds this year, Bloomberg data shows. Researchers at LSE Group said outstanding green bonds have grown at a compound annual rate of around 30% over the past five years and now account for roughly 4.3% of global bond issuance.

Easing US interest rates and refinancing needs could lift global green bond issuance to as much as $1.6 trillion next year, according to Crystal Geng, ESG research lead for Asia at BNP Paribas Asset Management.

Green equities have also led markets this year. Clean-energy indices from S&P Dow Jones Indices and WilderShares have risen by around 45% and 60% respectively, although both remain below their peaks reached in 2021.