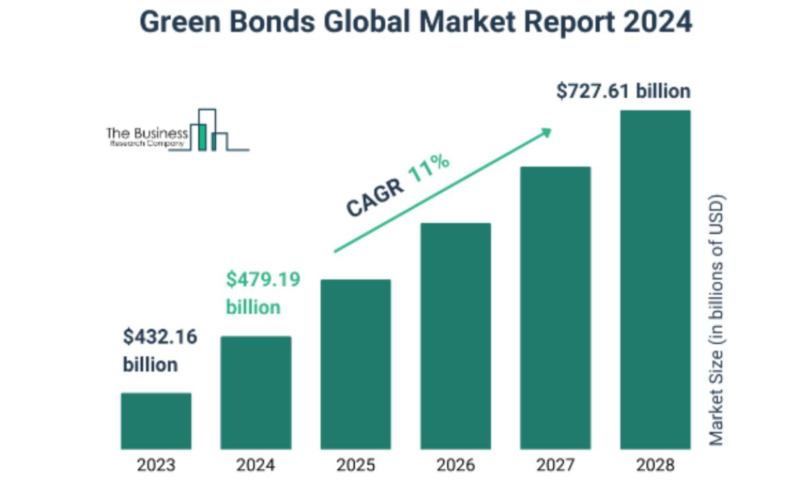

The global green bonds market has grown significantly, increasing from $432.16 billion in 2023 to $479.19 billion in 2024, reflecting a compound annual growth rate (CAGR) of 10.9%. According to a report by Business Research Company key drivers of this expansion include heightened environmental awareness, regulatory support, increased demand for ESG (Environmental, Social, and Governance) investments, and corporate sustainability efforts.

Forecasts suggest that the market will continue to grow, reaching $727.61 billion by 2028 with an estimated CAGR of 11%. This growth is fueled by stricter ESG regulations, climate change initiatives, investor interest in sustainable projects, and rising public awareness. Emerging trends such as blockchain integration, digital finance technologies, and the introduction of innovative instruments like digital green bonds are also boosting market expansion.

Green bonds are fixed-income securities designed to raise capital for projects that yield environmental benefits, such as reducing carbon emissions, improving energy efficiency, and promoting sustainable resource management.

The surge in sustainable investments is further propelling the green bonds market. These investments, which prioritise ESG criteria, aim to generate positive environmental and social outcomes while providing competitive financial returns. Growing awareness of environmental issues and the adoption of corporate social responsibility (CSR) and ESG practices by companies make sustainable investments increasingly attractive. Green bonds, in particular, offer dedicated funding for environmentally focused projects, allowing investors to align their portfolios with sustainability objectives.

Leading players in the green bonds market include major financial institutions such as JPMorgan Chase, HSBC, Citigroup, Morgan Stanley, and Barclays, among others. Many of these companies are incorporating blockchain technology into their operations, particularly through the tokenization of digital green bonds, which improves transparency, transaction efficiency, and traceability of environmental impact.

In terms of market segmentation, green bonds can be categorised by type—such as corporate bonds, project bonds, asset-backed securities (ABS), and municipal bonds. They are issued by both public and private sector entities, with energy, utilities, financial institutions, and government sectors being the primary end-users.

Geographically, North America led the green bonds market in 2023, while Asia-Pacific is expected to be the fastest-growing region during the forecast period.