GRESB and the Institutional Investors Group on Climate Change (IIGCC) have unveiled a new methodology to assess whether infrastructure assets are aligned with the Net Zero Investment Framework (NZIF) 2.0, the leading tool used by investors to design net-zero strategies and transition plans.

The initiative follows a pilot programme launched in May 2025, which tested NZIF criteria across a cohort of infrastructure managers and operators. The findings will be integrated into the 2026 GRESB Infrastructure Standards, providing investors with a consistent and comparable framework for evaluating climate progress.

Under the pilot, asset managers participating in the GRESB Infrastructure Asset Assessment submitted additional data, which was evaluated against NZIF’s multi-criteria maturity scale. Results provided insights into emissions disclosure, governance, decarbonisation planning and measurable reductions in emissions.

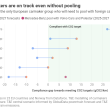

Early findings suggest that 16% of respondents reported achieving net zero, while 62% had committed to alignment. However, gaps remain: only half have adopted science-based targets, and fewer than half disclosed full Scope 3 emissions. Around 42% reported actual declines in emissions.

The pilot was developed in partnership with APG and supported by a working group of 11 global infrastructure investors and managers, including Aberdeen, Arcus, DIF Capital Partners, DWS, IFM Investors, J.P. Morgan, Macquarie, Morrison Global, PATRIZIA, and PGGM.

GRESB said the new approach would provide the sector with a “common language” for sustainability reporting, while IIGCC highlighted its role in supporting investor decision-making. The integration into GRESB’s standards is intended to streamline reporting and give investors a more reliable view of net-zero progress across infrastructure portfolios.