The European Parliament has voted to significantly reduce the number of companies required to report under the EU’s flagship sustainability laws, agreeing on amendments to the Corporate Sustainability Reporting Directive (CSRD) and the Corporate Sustainability Due Diligence Directive (CSDDD) as part of the Omnibus package adopted on 13 November.

Under the amendments, the reporting threshold for the CSRD would rise to companies with at least 1,750 employees and €450 million in revenue, placing most previously covered firms outside the scope of mandatory disclosure. The revised criteria would capture far fewer companies than the Non-Financial Reporting Directive (NFRD), which the CSRD replaced.

For the CSDDD, the threshold would be increased to 5,000 employees and €1.5 billion in revenue, while requirements for companies to publish climate transition plans would be removed.

The Global Reporting Initiative (GRI) criticised the Parliament’s position, arguing that the decision runs counter to business interests and will not achieve the intended regulatory simplification. GRI warned that the changes leave “thousands of companies in limbo” as they face continued pressure from stakeholders to disclose sustainability performance despite the rollback in mandatory requirements.

The vote also contradicts a joint public call backed by more than 480 companies, investors and organisations—including GRI—urging EU policymakers to preserve the core elements of the bloc’s sustainable finance framework throughout the simplification process.

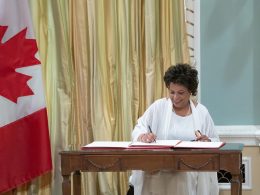

“The position adopted by the European Parliament is a backward step for the EU – and undermines European leadership on sustainability,” said Robin Hodess, CEO of GRI. “The EU risks misjudging the interests and needs of business, which is to pivot toward sustainability as a source of resilience and competitive advantage.”

Hodess added that raising the CSRD threshold would cut the number of covered companies by 92%, limiting access to reliable, decision-useful sustainability data for investors, regulators and companies themselves.

GRI, which helped develop the European Sustainability Reporting Standards (ESRS) and shaped the EU’s double materiality approach, said it remains ready to work with EU institutions through the upcoming trilogue negotiations to help deliver a consistent and competitive sustainability reporting landscape.