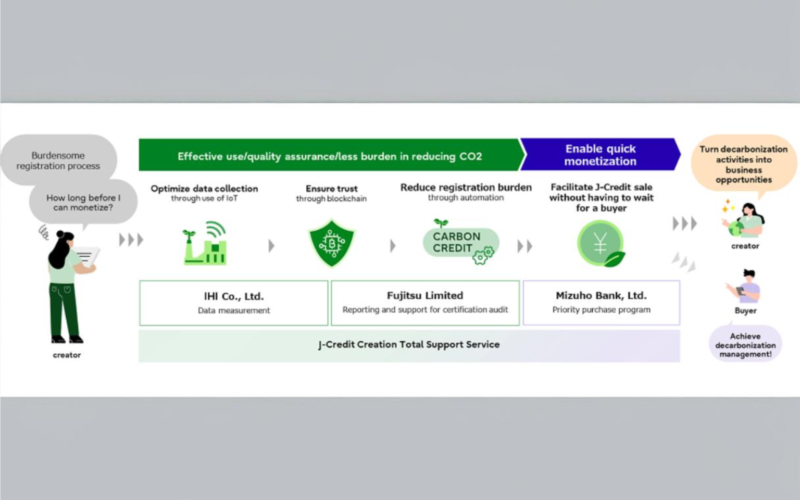

IHI Corporation, Fujitsu Limited, and Mizuho Bank, Ltd. have announced the signing of a Memorandum of Understanding (MoU) to jointly launch the J-Credit Creation Total Support Service. This service aims to simplify the J-Credit creation process and support rapid monetization for J-Credit creators, offering a streamlined solution to address the complexities and delays in the existing system.

The J-Credit scheme, which certifies greenhouse gas reductions or absorption, currently requires companies to go through extensive procedures, from project registration to credit creation. Additionally, there is the risk of delayed monetization if buyers are not secured. To address these issues, the partnership will combine Mizuho Bank’s extensive network with IHI and Fujitsu’s MRV Support System—a blockchain-based platform developed to digitize and automate the creation of environmental value. This collaboration aims to ease the burden on J-Credit creators and enhance the speed of the credit creation process.

The joint business venture plans to offer J-Credit creation support for activities such as emissions reductions via the introduction of photovoltaic power generation facilities starting in the first quarter of fiscal 2025. By combining Fujitsu’s blockchain technology, IHI’s engineering expertise in data collection, and Mizuho Bank’s access to a vast customer base, the service will provide a one-stop solution for reliable data management, application automation, and efficient credit creation.

“The combination of these technologies and networks enables a highly efficient system for generating credible environmental value, contributing to the realisation of a decarbonised society,” said a representative from IHI. Mizuho Bank, as the only financial institution recognized as a “Best Market Maker” by the Tokyo Stock Exchange in its carbon credit market, will help promote the liquidity and growth of the J-Credit market.

Fujitsu’s Uvance business model will also play a crucial role, providing AI-powered ESG management tools that optimise CO2 reduction data, allowing businesses to make informed decisions and accelerate their sustainability transformations.