The Climate Policy Initiative (CPI) has unveiled its latest ‘Landscape of Green Finance in India’ report, presenting a detailed analysis of green finance flows across key sectors in the country. The findings showcase a notable rise in tracked green finance, with investments in mitigation sectors reaching INR 3,712 billion (USD 50 billion) in 2021-22 which is a 20% increase from 2019-20. This growth is particularly significant given the economic disruptions caused by the COVID-19 pandemic.

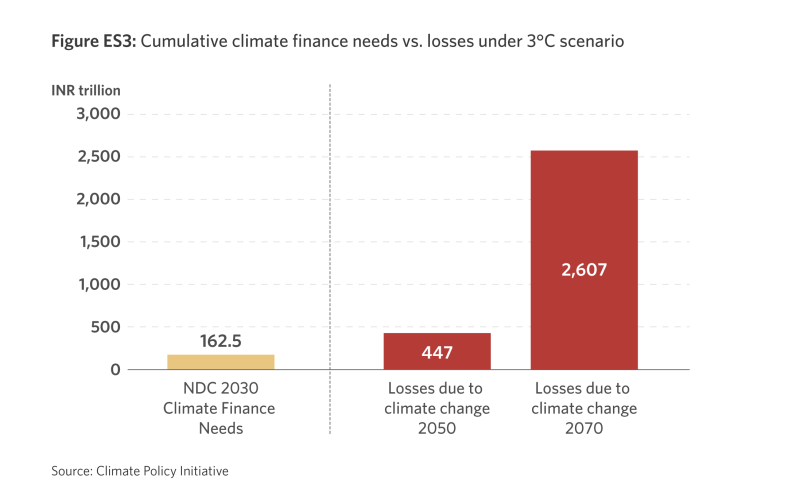

Adaptation finance has also seen a remarkable rise, nearly tripling over the same period to INR 1,092 billion (USD 15 billion) annually in 2021/22. For the first time, the report includes an analysis of finance flows directed towards adaptation-related on-farm activities in agriculture. However, CPI cautions that India’s high vulnerability to climate change means that adaptation investment needs are likely to grow further in the coming years.

Speaking at the report’s launch, Vivek Sen, Director of Climate Policy Initiative India said, “India’s green finance landscape has made significant progress, but there is a long road ahead. This report highlights critical areas where action is needed to scale investments and bridge existing gaps.”

The report identifies key priorities for scaling up green finance to support India’s transition to a low-carbon, climate-resilient economy: policy and regulatory measures to mobilise green finance, accelerating green finance through coordination, enhancing finance for adaptation and improving data collection & reporting.

The report emphasises that collaborative efforts among policymakers, financial institutions, and private stakeholders are essential to increasing green investments. By addressing policy gaps, incentivising private capital, and improving data systems, India can accelerate its journey towards a sustainable and climate-resilient future. The findings serve as a crucial reminder of the urgent need to mobilise green finance to meet India’s climate goals and ensure the country’s economic and environmental sustainability.