Integrum ESG, a leading provider of alternative ESG data, has announced the launch of its new Consensus ESG Ratings module. Similar to how investors track movements in consensus earnings estimates or credit ratings, there is now a growing demand for tools to monitor both long-term trends and short-term shifts in consensus ESG ratings.

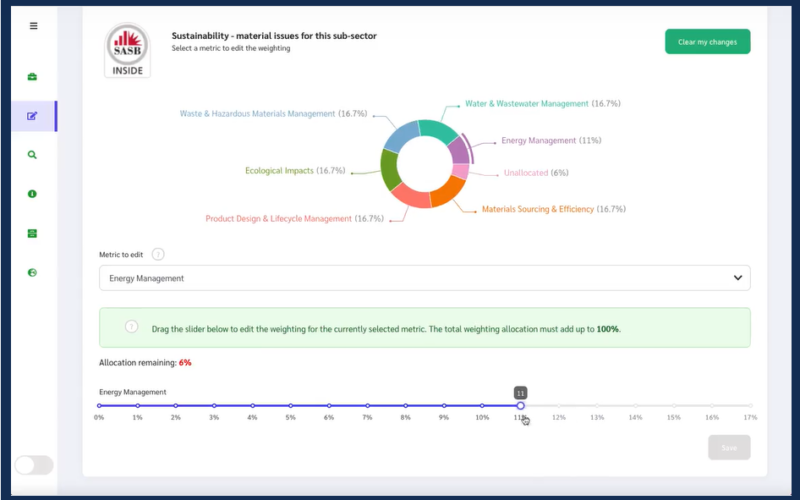

With this new feature, Integrum ESG’s asset manager clients can access consensus ESG scores for any company, available as either an absolute rating or a relative percentile ranking, across a 10-year time series. These scores provide insights into what the capital markets have “priced in” regarding a company’s ESG performance, allowing investors to quickly grasp market sentiment and easily perform relative ESG analysis on their portfolio holdings.

This regularly updated data is provided by CSRHub, the world’s top provider of consensus ESG ratings. CSRHub aggregates and normalises data from a wide array of licensed sources, including major ESG ratings firms like MSCI, ISS, S&P Global, and Sustainalytics, as well as specialised providers such as CDP and Better World Companies.

Shai Hill, Founder and CEO of Integrum ESG said, “Many investors have told us they want a sense of ‘what is priced in’ in terms of a company’s ESG performance, so they can compare this to what anyone ESG ratings firm is saying. CSRHub is the only firm to have credibly achieved this, thanks to a model refined over years and a vast data lake – so we are delighted to be partnering with them.”

Bahar Gidwani, Co-Founder of CSRHub said, “Investors need to fine tune their ESG-related investment strategies to improve their returns and better match the preferences of their clients. Combining CSRHub’s expert outside-in, consensus view of ESG with Integrum ESG’s detailed real-time data stream provides a strong solution for these needs.”