A recent report from Morgan Stanley’s Institute for Sustainable Investing has revealed a growing appetite among American workers for incorporating sustainable investments into their retirement plans—yet awareness and actual uptake remain significantly limited.

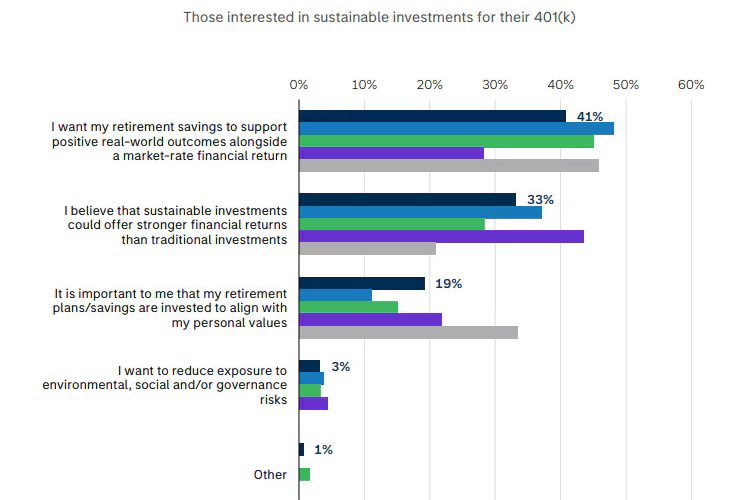

According to the study, 75% of surveyed individuals with a 401(k) or similar employer-sponsored savings plan expressed interest in sustainable investing. This interest was primarily driven by a belief in the financial viability of such investments rather than environmental or social motivations. However, only 36% of respondents were aware of any sustainable investment options available within their plans.

These findings echo earlier behavioural research on ESG (environmental, social, and governance) investing by Samantha Lamas, a senior behavioural insights researcher at Morningstar. “A lot of individual investors were more motivated by the financial benefits of ESG versus social aspirations,” she noted, adding that interest in ESG has historically been moderate, even during its peak popularity.

Performance data over recent years may explain part of this hesitancy. Between 2022 and 2024, sustainable funds underperformed the broader market, trailing the Morningstar US Market Index by over seven percentage points. However, in 2024, this trend reversed, with US-domiciled sustainable funds posting an average return of 7.23%, outpacing the 5.99% return of the broader index.

Yet despite this rebound, other barriers persist. Morgan Stanley’s report highlights a gap between employee interest and employer perception. While employees reported strong enthusiasm for sustainable options, 62% of corporate respondents rated employee interest as “low or moderate.” Furthermore, many employers noted a disconnect between stated interest and actual engagement—a pattern Lamas refers to as the “do-should gap.”

This phenomenon, observed across both financial and consumer behaviours globally, underscores a broader challenge: people often fail to act on their values due to a lack of knowledge, tools, or behavioural triggers. “You need a person holding you accountable or technology that helps you,” said Lamas. “What if you could click a dial that incorporates sustainable investments into your retirement plan?”

In addition to behavioural hurdles, regulatory uncertainty has emerged as a key obstacle. Several companies cited concerns over fiduciary duties and shifting legal interpretations as reasons for caution. At the heart of this issue is the Department of Labor’s interpretation of the Employee Retirement Income Security Act (Erisa), which was revised in 2022 under the Biden administration. The update allows fiduciaries to consider the economic impacts of climate change and other ESG factors when evaluating investment options—provided they are deemed material to risk and return.

However, recent commentary from legal experts, including those at Goodwin Procter LLP, warns that pending changes could expose fiduciaries to increased litigation risk. Should the burden of proof regarding the prudence of ESG factors shift to the plan sponsor, it could deter broader integration of sustainable options into retirement portfolios.

While the desire for sustainable investing is clearly rising, Morgan Stanley’s report suggests that a mix of limited awareness, underperformance concerns, behavioural inertia, and regulatory ambiguity is preventing employees and employers from turning interest into action. Nevertheless, as Lamas writes, the current gap is “both a warning… and an opportunity”—pointing to a future where better tools, clearer rules, and more accessible choices could help align investment practices with long-term sustainability goals.