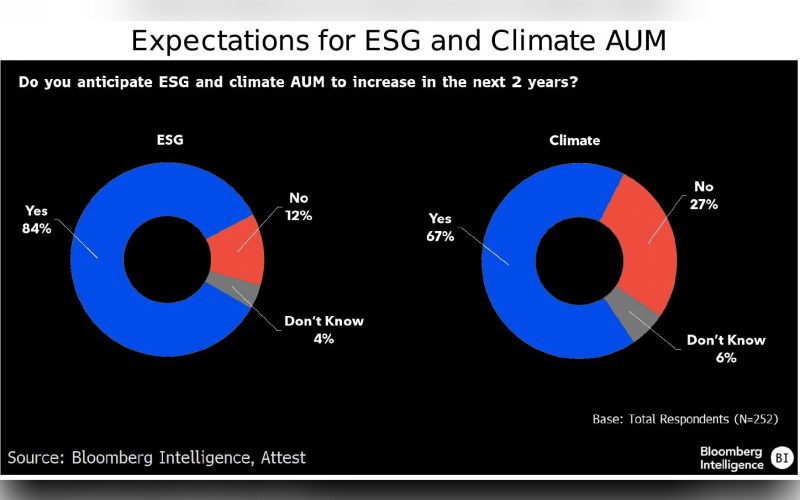

Nearly 85% of investors expect assets under management (AUM) dedicated to Environmental, Social and Governance (ESG) strategies to increase over the next two years, according to Bloomberg Intelligence’s latest ESG Investor Survey.

The survey of 252 investment professionals, conducted between 26 March and 7 May across North America, Europe, Asia-Pacific, Central and South America, found that two-thirds of respondents anticipate growth in climate-related AUM over the same period. Almost half of those surveyed said they expect more than 15% of their portfolios to be devoted to ESG products, with 44% anticipating similar levels of allocation to climate-focused funds.

Despite ongoing political and market pushback against ESG, investors continue to see long-term value in the approach. Respondents most frequently cited a stronger understanding of industries, more informed investment decision-making and improved risk-adjusted returns as key benefits.

The survey also highlighted widespread integration of climate considerations. Nearly 90% of investors reported assessing the carbon footprint of their portfolios, although many noted data gaps — particularly around climate scenario analysis, Scope 3 emissions and physical risk. Even so, the majority said they draw on ESG data and scores to evaluate companies’ climate strategies.

When asked about the impact of corporate energy-transition strategies, 71% of respondents said they enhance competitiveness and market share, while 59% linked them to higher revenues.

Emerging themes are also beginning to shape investor expectations. Artificial intelligence was named by more than 45% as the next major ESG focus, with cybersecurity cited by 39% and water by 25%. Respondents also identified the “risks and opportunities of AI in ESG” as the top issue for 2025.