Asset manager Keppel, the Asian Development Bank (ADB), and Enterprise Singapore (EnterpriseSG) have signed a Memorandum of Understanding (MOU) to explore energy transition, environmental sustainability, and blended finance opportunities in Asia and the Pacific, totaling $800 million.

These projects are expected to enhance the pipeline of high-quality, proprietary infrastructure assets for Keppel’s private funds and listed business trust. The collaboration on blended finance, which includes the potential use of concessionary financing, aims to improve bankability, support development outcomes, and attract private investment for these initiatives.

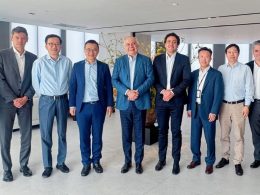

The MOU was signed by Cindy Lim, CEO of Keppel’s Infrastructure Division, Bhargav Dasgupta, Vice-President for Market Solutions at ADB, and Cindy Khoo, Managing Director of EnterpriseSG, at ADB’s headquarters in Metro Manila, Philippines.

Keppel plans to develop and operate energy transition and environmental sustainability projects across the Asia-Pacific region, focusing on areas such as decarbonizing power generation, renewable energy, electric mobility, green buildings, water treatment, and resource recovery from waste, including bio-energy and waste-to-energy projects. Once completed, these initiatives are projected to reduce at least 1 million tonnes of CO2e annually.

ADB, Keppel, and EnterpriseSG will initially focus on Southeast Asia, seeking climate financing solutions to support these projects, with a total value exceeding $800 million between 2025 and 2030.

EnterpriseSG will also assist Keppel in accessing markets through its network of over 35 overseas centres, connecting Keppel with relevant in-market partners, navigating regulatory landscapes, and identifying financing resources available at different stages of the projects.

Cindy Lim, CEO of Keppel’s Infrastructure Division said, “As the global push towards decarbonisation accelerates, the demand for financing to support clean energy transition and environmental projects across the Asia Pacific has never been greater. Keppel offers technical expertise and innovative solutions for large-scale sustainable infrastructure projects. Leveraging our unique strengths as a global asset manager and operator, we can also mobilise external capital from partners effectively. Coupled with ADB’s concessionary financing and regional cooperation expertise, as well as EnterpriseSG’s deal-matching and market access capabilities, our partnership is uniquely positioned to drive impactful change and help the region achieve green growth.”

ADB’s Vice-President for Market Solutions Bhargav Dasgupta said, “Accelerating the global clean energy transition is imperative to put the planet on a pathway to sustainable development and ultimately its own survival. Private sector innovation and investment are crucial to drive this change. As Asia and the Pacific’s climate bank, ADB will continue to partner with the private sector on innovative solutions to power the region’s low-carbon future.”

Cindy Khoo, Managing Director of EnterpriseSG, said “As the world races to close the gap for decarbonisation, the collaboration between the public and private sectors will be crucial in accelerating the development and deployment of climate tech solutions at scale. This is why EnterpriseSG has embarked on this partnership with Keppel and ADB to share our networks and resources to catalyse and address impactful sustainability projects in the region.”