The Least Developed Countries Report 2024, published by the UN Conference on Trade and Development (UNCTAD), emphasises that Least Developed Countries (LDCs) can harness carbon market projects to advance their development goals while contributing to global net-zero targets, provided these projects are managed effectively.

Carbon markets facilitate the buying and selling of carbon credits—permits to offset specified amounts of carbon emissions—allowing LDCs to generate revenue while aiding global climate action.

Despite being early adopters, LDCs currently play a limited role in carbon markets due to their smaller economies and infrastructure, technological, and institutional challenges. Investment in tracking and reporting systems, while requiring initial funding, could significantly boost their participation and benefits in these markets.

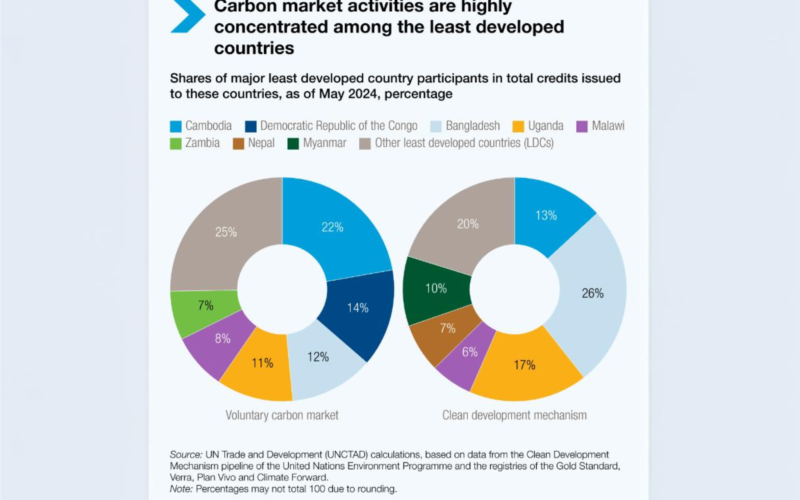

LDCs encounter distinct obstacles in global carbon markets due to economic scale and difficulty attracting foreign investment. Market activity is highly concentrated: six LDCs—Bangladesh, Cambodia, the Democratic Republic of the Congo, Malawi, Uganda, and Zambia—constitute over 75% of all voluntary carbon credits and 80% of credits under the Kyoto Protocol’s Clean Development Mechanism (CDM). Although LDCs represent only 1.5% of global CDM projects, this concentration highlights an opportunity to broaden access and develop more inclusive carbon markets across all LDCs.

While LDCs are active in carbon markets, financial returns remain modest compared to other funding sources such as development aid, foreign direct investment, and remittances. In 2023, carbon credits from LDCs were valued at around $403 million—only 1% of total bilateral aid.

LDCs, which need $1 trillion annually to meet the Sustainable Development Goals by 2030, cannot rely solely on carbon markets to bridge this funding gap. However, carbon markets offer additional support for sectors with untapped potential, like forestry and agriculture, which could offset nearly 2% of total global emissions, or 70% of CO2 from global aviation in 2019. Unlocking this potential requires viable carbon pricing; a price of $100 per ton is essential to make land-based projects economically feasible. Currently, LDCs are using only 2% of this potential, with 97% likely to remain unused by 2050 if prices stay low.

Expanding renewable energy capacity presents another promising avenue for LDCs to improve energy access and modernise their economies. Carbon markets could supply part of the necessary funding for renewable projects, fostering sustainable growth and reducing reliance on fossil fuels.

To maximise the benefits of carbon markets, UNCTAD advises LDCs and development partners to focus on three priorities: Invest in regulatory capacity, establish effective monitoring and reporting systems, and ensure local communities benefit from carbon projects; Develop regional institutions to lower market entry costs, leverage South-South cooperation, and advocate for supportive policies in international climate agreements, and; Encourage development partners to support LDCs in integrating carbon market policies with economic transformation objectives. Distinguishing carbon finance from climate finance is essential to enhance accountability.

UNCTAD concludes that carbon markets can play a significant role in LDC development. By overcoming current barriers and enacting targeted reforms, LDCs can unlock substantial climate action potential, generate financial gains, and stimulate economic progress while contributing meaningfully to global climate goals.