The Net-Zero Asset Managers (NZAM) initiative has suspended its activities after BlackRock, the world’s largest asset manager, exited the coalition. The pause raises concerns about the future of climate commitments within the asset management industry as political pressure mounts in the United States.

BlackRock, which manages $11.5 trillion in assets, left the initiative on 9 January, citing confusion over its climate efforts and legal inquiries. The decision comes amidst escalating criticism from Republican lawmakers questioning the firm’s stance on investments in fossil fuel companies.

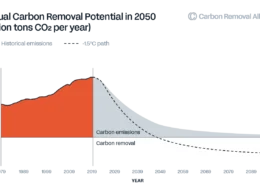

NZAM, launched in 2020, aimed to align asset managers with the Paris Agreement’s net-zero emissions goals by 2050. Before BlackRock’s departure, the coalition had over 325 signatories managing $57.5 trillion in assets.

In a letter to its members, NZAM cited “recent developments in the US” as a reason for launching a review of its operations. The group wrote that it has temporarily halted activities, including tracking signatory implementation and reporting, and will also remove, targets, signatory lists and case studies from its website.

The suspension has sparked concerns that political tensions may hinder progress on climate goals. Advocacy groups worry that these developments could slow efforts to address global emissions, especially after the hottest year on record.

NZAM’s pause comes as political challenges to ESG strategies intensify in the US Republican lawmakers have criticised ESG investments, alleging they harm fossil fuel production and raise energy prices. Pressure includes lawsuits and congressional inquiries targeting fund managers’ climate stances.

Despite these challenges, members like State Street’s asset management division have expressed cautious support for NZAM’s review. Others, including JPMorgan Asset Management, declined to comment.

The outcome of NZAM’s review will be pivotal in shaping the future of climate action within the financial sector, influencing how asset managers balance political pressures with global sustainability goals.