Novata, a sustainability data platform for private markets, has launched a new ESG Due Diligence solution aimed at simplifying and centralising pre-investment sustainability assessments for deal professionals. The tool allows users to request, analyse and contextualise ESG data within a secure environment, with seamless integration into post-investment portfolio monitoring.

Designed to alleviate the administrative burden on investment teams, the solution offers a streamlined workflow from initial diligence through to exit. It facilitates efficient risk and opportunity analysis and enables users to automatically transfer ESG data collected during due diligence to Novata’s monitoring platform.

Key features include:

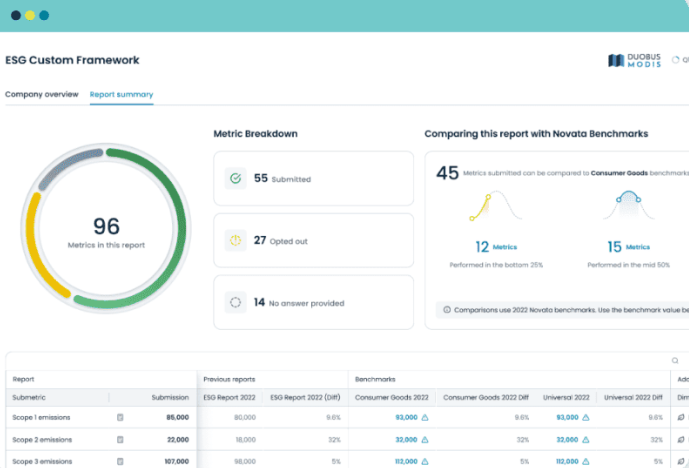

- A self-serve setup and secure access for deal teams and target companies

- Real-time benchmarking against market and portfolio-level data

- Collaborative workflows for targeted data review

- Digitised scoring for concise, actionable outcomes

- Full integration with Novata’s performance tracking tools

“Assessing sustainability factors is now a standard part of investment processes, yet traditional methods remain labour-intensive, fragmented, and difficult to link to long-term value creation,” said Jessie Martin, Global Head of Advisory at Novata. “Our new solution offers a practical, low-friction alternative for investment teams.”

The platform combines user-friendly technology with optional advisory support, aiming to reduce diligence costs and better connect ESG metrics with financial performance over the investment period.

Patrick Crowley, Head of Product for Investors at Novata, added: “We designed this platform to meet deal teams where they are—offering an intuitive, scalable approach that embeds sustainability considerations naturally into the investment lifecycle.”

Novata’s latest development aligns with its broader mission to foster a more sustainable and inclusive model of capitalism within the private markets.