Singapore Exchange Regulation (SGX RegCo) has reaffirmed that while there is no fixed timeline for Scope 3 emissions reporting, larger market capitalisation companies will be prioritised, with reporting expected to commence from FY2026.

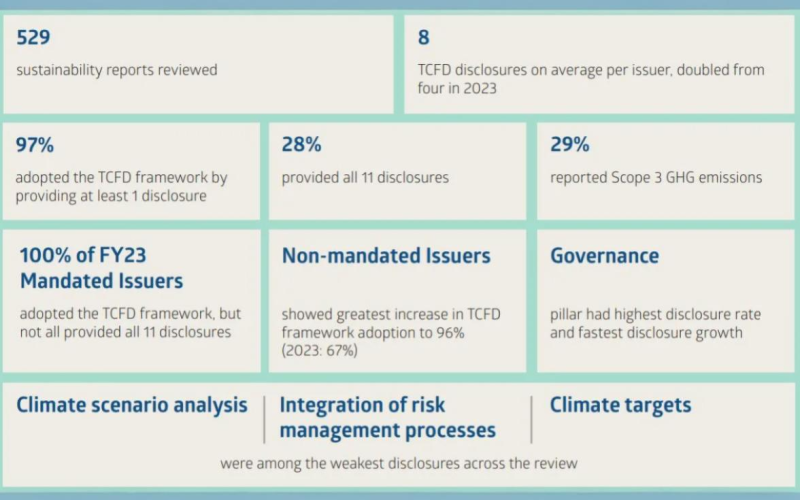

A review by SGX RegCo and the NUS Business School’s Centre for Governance and Sustainability (CGS) found that nearly all issuers listed on the Singapore Exchange (SGX) had included climate-related disclosures in their sustainability reports as of 31 July 2024. The findings, published in the Climate Reporting Review 2024, revealed that 97% of the 529 sustainability reports examined included at least one disclosure aligned with the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, up from 73% in 2023.

However, full adoption of the TCFD framework remains limited. While 61% of issuers provided at least nine TCFD disclosures, only 28% fully disclosed all 11 recommendations across governance, strategy, risk management, and metrics and targets. On average, each issuer made eight TCFD disclosures, an increase from four in 2023. The weakest areas included climate scenario analysis, risk management integration, and climate target setting.

SGX has taken a phased approach to mandatory climate reporting, following a 2021 public consultation. Issuers in agriculture, food and forest products, energy, and financial sectors were required to disclose all 11 TCFD recommendations from FY2023, while those in materials, buildings, and transportation must comply from FY2024. Other issuers continue to report on a “comply or explain” basis. Despite these mandates, only 36% of issuers subject to full disclosure requirements met all 11 recommendations.

Companies should enhance transparency by detailing how boards and management oversee climate-related issues and integrate them into strategic decision-making, said Professor Lawrence Loh, director of CGS. He emphasised that climate risks should be embedded into enterprise risk management rather than viewed in isolation.

The review highlighted significant improvements in Scope 1 and Scope 2 greenhouse gas (GHG) emissions reporting. Scope 1 emissions disclosure rose from 50% in 2023 to 80%, while Scope 2 disclosures increased from 61% to 87%. However, Scope 3 emissions reporting remains less widespread, with only 29% of issuers providing such disclosures, up from 15% in 2023. These emissions cover indirect sources such as business travel and supply chain activities.

Larger companies are significantly ahead in Scope 3 reporting. Among issuers with market capitalisation exceeding $1 billion, 64% reported Scope 3 emissions in 2024, up from 51% the previous year. In contrast, only 22% of smaller firms (market cap below $300 million) disclosed Scope 3 data, though this was an improvement from just 6% in 2023. Professor Loh recommended that companies begin with measurable Scope 3 categories, such as business travel, before expanding reporting to other areas.

In September 2024, SGX RegCo mandated that all issuers report Scope 1 and Scope 2 emissions from FY2025. Additionally, climate-related disclosures must align with the International Financial Reporting Standards (IFRS) sustainability disclosure standards issued by the International Sustainability Standards Board (ISSB) in June 2023. However, the regulator acknowledged challenges, particularly for smaller firms, and will assess issuers’ readiness before setting a concrete roadmap for Scope 3 reporting.

SGX RegCo reiterated its position that Scope 3 reporting will prioritise larger issuers rather than adopting a sectoral phase-in approach, as was done for TCFD-aligned reporting. While the regulator has yet to define the market capitalisation threshold for prioritisation, it has underscored its commitment to supporting issuers through the transition.

Michael Tang, head of SGX RegCo’s sustainable development office, confirmed that the first batch of Scope 3 disclosures is expected in FY2026, aligning with the one-year transition relief provided under IFRS sustainability standards. “We are closely monitoring the situation and expect to provide further guidance soon.”

To aid companies in navigating mandatory climate reporting, SGX RegCo has collaborated with the Institute of Singapore Chartered Accountants (ISCA). A new one-day training workshop, comparing Global Reporting Initiative (GRI) and ISSB standards, will launch on 17 April, with seven additional sessions scheduled until September. SGX RegCo will subsidise training fees for up to 400 participants.

In October 2024, ISCA also introduced an illustrative sustainability report to serve as a reference for listed companies. The 62-page document is modelled on a hypothetical real estate entity in Singapore, offering contextual insights and guidance notes to support issuers in meeting disclosure requirements.

“SGX RegCo will continue engaging with companies to identify further areas of support,” Tang added, reinforcing the regulator’s commitment to easing the transition towards comprehensive climate reporting.