Sustainability and affordability are reshaping the global luxury retail market, according to new research from the inaugural EY Luxury Client Index. The study, which surveyed 1,600 aspirational luxury consumers across ten markets, highlights a shift away from pure exclusivity towards quality, conscious consumption, and innovative, sustainable practices.

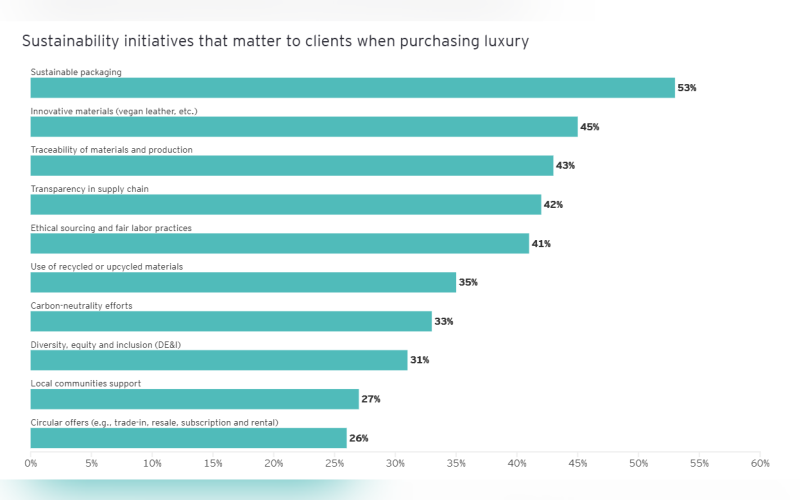

While 71% of consumers cite product quality as the leading driver of luxury purchases, sustainability is now on par with price as a deciding factor, with 31% placing it among their top five priorities. Initiatives such as sustainable packaging (valued by 53% of respondents) and innovative materials (45%) are increasingly influencing buying behaviour, particularly in the UK and Mainland China.

The report also reveals the growing appeal of pre-owned and rental options. More than half (54%) of clients said they would buy certified pre-owned luxury goods directly from a brand, while 50% would consider renting items for convenience or special occasions. This signals a major growth opportunity for luxury maisons to reclaim the resale market from third-party platforms, strengthen brand loyalty, and reinforce sustainability credentials.

Price sensitivity remains a significant barrier to growth, with 62% of aspirational clients forgoing luxury purchases in the past year due to cost concerns. Many are delaying purchases until affordable, with Gen X consumers and clients in Japan and the UK especially cautious.

EY experts say this marks a pivotal moment for the industry. “Luxury brands must redefine value beyond exclusivity and heritage,” said Silvia Rindone, EY-Parthenon UK&I Retail Lead. “British clients, in particular, are prioritising sustainability and more conscious purchasing. Brands that embrace pre-owned, rentals, and sustainable innovation will resonate most strongly with today’s discerning consumer.”

Despite the rise of digital channels, physical stores continue to dominate luxury retail, with 75% of respondents making their latest purchase in-store. However, seamless omnichannel experiences are becoming increasingly important, especially for younger generations and in high-growth markets like the UAE.

Rachel Daydou, Partner, Luxury AI & Sustainability at EY Fabernovel, added: “Luxury maisons have long resisted resales to protect exclusivity. But certified pre-owned and rentals represent a tremendous opportunity—not only to close the gap with third-party platforms but also to meet consumer expectations for value and sustainability in a way that strengthens brand equity.”

The findings suggest that sustainability-led innovation, pre-owned sales, and rentals may be the luxury industry’s most effective levers to revitalise growth in a market under pressure from shifting consumer values.