A new study commissioned by Transport & Environment (T&E) has revealed that there are no EU-wide or national requirements governing technology transfer or compliance with air pollution regulations for battery factories in Poland and Hungary. The environmental group is calling for clear foreign investment rules and a comprehensive European strategy for battery supply chains.

The report highlights that, despite receiving €900 million ($941 million) in state aid from the Hungarian and Polish governments, no environmental or social conditions were attached by the European Commission to the CATL battery plant in Hungary or the LG Energy Solution facility in Poland. Investigations conducted by Carbone 4 and independent experts also found that two other EU-Chinese partnerships – VW-Gotion in Germany and CATL-Stellantis in Spain – focus solely on short-term battery supply rather than long-term skill and technology transfer.

In Poland and Hungary, funding for these battery plants has often been drawn from the EU’s post-Covid recovery fund. However, both facilities have breached the EU’s Industrial Emissions Directive by exceeding permitted levels of N-Methyl-2-pyrrolidone (NMP), a toxic solvent used in cathode manufacturing. Additional concerns in Hungary include inadequate water management and energy supply infrastructure. These environmental breaches compound the poor working conditions widely reported in the Hungarian battery industry.

The investigation also examined technology transfer issues in Germany and Spain. At VW-Gotion, where Volkswagen invested €1.1 billion for a 26.47% stake, experts found that the German carmaker had little influence over battery operations, with the partnership appearing to serve merely as a means of securing iron-based (LFP) battery supplies. Similarly, the Stellantis-CATL joint venture in Spain, which received nearly €300 million in state aid, has not led to any significant long-term technology transfer. Experts attribute these issues to a lack of EU and national regulations on technology transfer and local content requirements, a stark contrast to policies in China and the US.

Julia Poliscanova, Senior Director for Vehicles & E-mobility at T&E, criticised the current state of affairs and said, “Asian-EU partnerships were presented as knowledge-sharing vehicles, but they are not translating into local gains. Worse still, some fail to meet environmental regulations or EU labour standards. Member states must ensure environmental and workplace conditions are upheld, while the European Commission must use all legal tools—state aid, trade, procurement, and foreign investment rules—to require intellectual property transfer. With over 650 GWh of battery capacity coming from South Korean and Chinese companies, the EU must prevent a race to the bottom.”

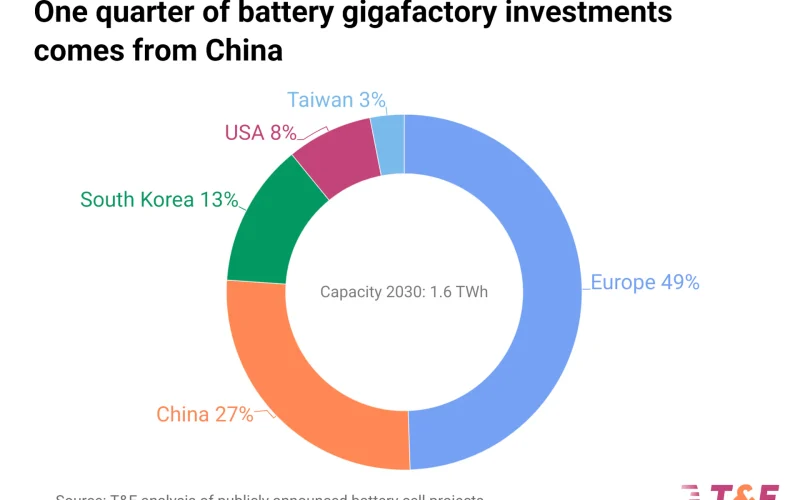

Currently, over 90% of electric vehicle and energy storage batteries in the EU are produced by Asian manufacturers, with 40% of announced gigafactories involving Chinese or South Korean firms. Without stronger regulatory intervention, Europe risks becoming little more than an assembly hub amid escalating geopolitical, economic, and security challenges.

T&E is urging the EU to present a comprehensive battery supply chain strategy on 5 March as part of its broader automotive action plan.

Poliscanova added, “The upcoming EU strategy to support the European automotive sector must address the battery challenge holistically. This includes launching an investigation into unfair Chinese battery subsidies, introducing resilience criteria for state aid, and implementing binding carbon footprint standards for batteries entering the EU market.”