A majority of global investors believe that former U.S. President Donald Trump’s energy policies, favouring fossil fuels and opposing clean energy, would hinder progress towards global net-zero targets if he returns to office. However, most expect the momentum for climate action to recover under future U.S. leadership, according to Robeco’s 2025 Global Climate Investing Survey.

The survey, based on responses from 300 institutional and wholesale investors managing a combined USD 31.2 trillion in assets, reveals that 56% of respondents foresee Trump’s potential return as detrimental to the net-zero transition. Nearly six in ten (59%) say they will withhold key investment decisions involving affected assets until the future of U.S. policy becomes clearer.

Investors in Europe and Asia-Pacific appear more prepared to look elsewhere. A majority in both regions—58% in Europe and 62% in Asia-Pacific—say they are increasingly inclined to seek climate-related investment opportunities outside the United States.

A key concern echoed throughout the survey is the lack of coherent and consistent government support for climate goals. Many investors feel their own commitments towards net zero by 2050 are being undermined by lagging policy frameworks. Calls for more dependable and aligned action from policymakers are growing louder.

The perception of inadequate government support varies significantly by region. In Asia-Pacific and North America, 41% and 39% of investors respectively cited unsupportive economic policies as major barriers to decarbonisation. By contrast, only 25% of European investors felt the same, pointing to the stronger legislative backing for climate targets across Europe.

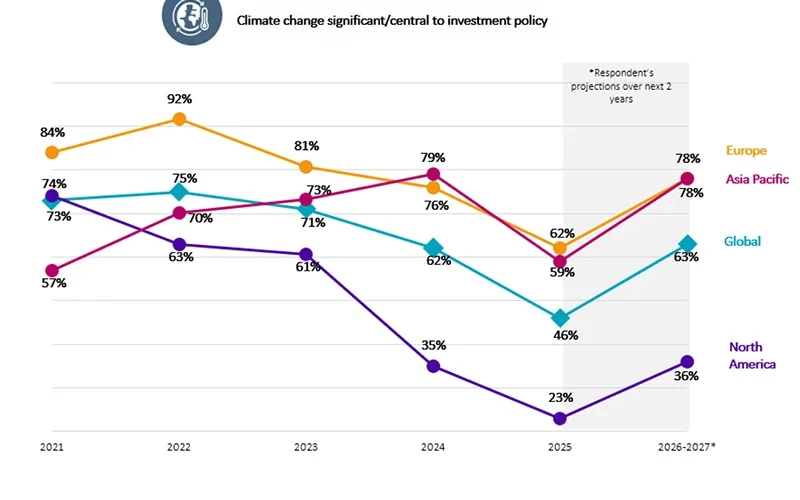

The divergence in policy support is also reflected in strategic priorities. While 62% of European and 59% of Asia-Pacific investors continue to make climate change central to their investment strategies, only 23% of their North American counterparts do so—a sharp drop in global alignment on climate investing.

Lucian Peppelenbos, Climate and Biodiversity Strategist at Robeco, noted that the findings reveal a “sobering reality.” “While many investors remain committed to climate goals, the overall prioritisation of climate change in investment strategies is showing signs of decline, particularly at the global level,” he said.

Peppelenbos added that Robeco remains committed to guiding clients through these evolving challenges, helping them align investment approaches with individual sustainability and financial goals. “Even amid uncertainty and shifting priorities, we remain steadfast in helping clients invest with clarity, resilience, and confidence,” he said.

The Robeco survey included investors from a diverse range of institutions such as pension funds, sovereign wealth funds, private banks, family offices, and insurance companies across Europe, North America, and Asia-Pacific. Respondents managed portfolios ranging from under USD 1 billion to over USD 1 trillion in assets.