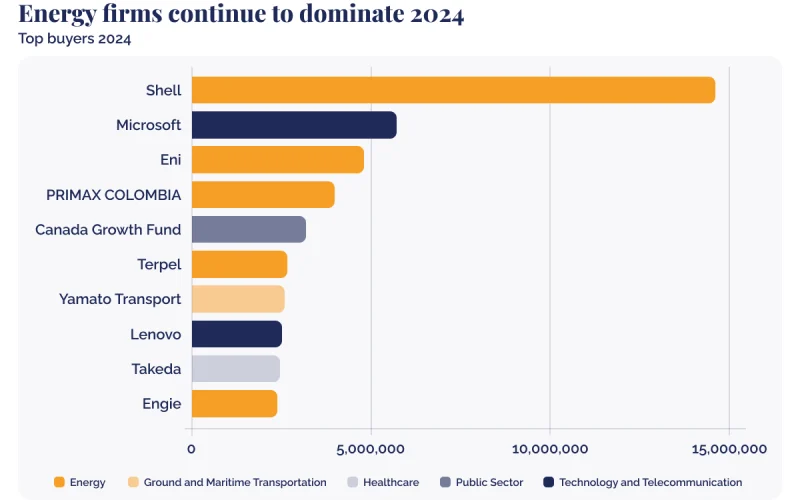

Shell and Microsoft have been named the largest buyers in the 2024 Voluntary Carbon Market (VCM), according to Allied Offsets. While both companies aim to reduce emissions, their approaches reveal contrasting priorities—Shell focuses on cost-effective scalability, while Microsoft invests in innovative carbon removal solutions.

Shell retired 14.5 million carbon credits in 2024, retaining its position as the top participant in the VCM for the second consecutive year. Of these, 9.4 million credits supported forestry and land-use projects aimed at preserving carbon stores and preventing emissions.

The company also retired 2.4 million renewable energy credits, with an average credit price of just $4.15, reflecting its strategy of prioritising affordability and large-scale impact. However, Shell has announced plans to reduce its investment in nature-based solutions, signalling a shift in its sustainability approach.

With a net-zero target by 2050 and interim goals to halve operational emissions by 2030, Shell’s focus remains on balancing environmental impact with cost-effectiveness.

Microsoft retired 5.5 million carbon credits in 2024, with nearly 80% allocated to bioenergy with carbon capture and storage (BECCS) projects. A landmark deal with Stockholm Exergi in Sweden highlighted its commitment to carbon-negative solutions, which capture and store emissions from biomass combustion.

This cutting-edge approach comes at a high cost. Microsoft’s average credit price reached $189 in 2024, significantly higher than Shell’s. Despite the expense, the tech giant remains committed to becoming carbon-negative by 2030, showcasing leadership in sustainable innovation.

The voluntary carbon market in 2024 saw increased interest in high-quality carbon removal projects like BECCS and direct air capture. However, overall credit retirements plateaued for the third consecutive year. Forestry and renewable energy credits, while still dominant, have seen their market share decline from 80% in 2020 to 70% in 2024.

Challenges persist, including an oversupply of older Clean Development Mechanism (CDM) credits, which have faced criticism for limited environmental impact. Despite these hurdles, the number of companies participating in the VCM rose slightly to over 6,500 in 2024, driven primarily by the energy and financial sectors.

Shell and Microsoft’s contrasting approaches to the carbon market reflect broader trends in corporate sustainability. Shell’s focus on affordability and scale is a pragmatic strategy to achieve widespread impact, while Microsoft’s investment in high-cost, high-impact solutions like BECCS underscores its commitment to innovation.